Comparative legal analysis of associations laws and regimes in the EU. Country Report: Finland

Executive summary

In Finland, associations are governed by the Associations Act.1 Under the Associations Act, an association can be established for the common realisation of a non-profit purpose and that purpose cannot be contrary to law or proper behaviour.2

There are registered and unregistered associations in Finland. Registration is optional, but only a registered association can obtain rights, make commitments and appear before a court or other authority as a party.

As the supreme source of law, the Constitution of Finland3 guarantees everyone the freedom of association that includes the right to form an association without a permit, to be a member or not to be a member of an association and to participate in the activities organized by an association. Freedom to form trade unions and to organise in order to look after other interests is also guaranteed.”4 Main source of law regarding associations in Finland, and subordinate to the Constitution, is the Associations Act5, that specifically states “associations are governed by this Act.”6

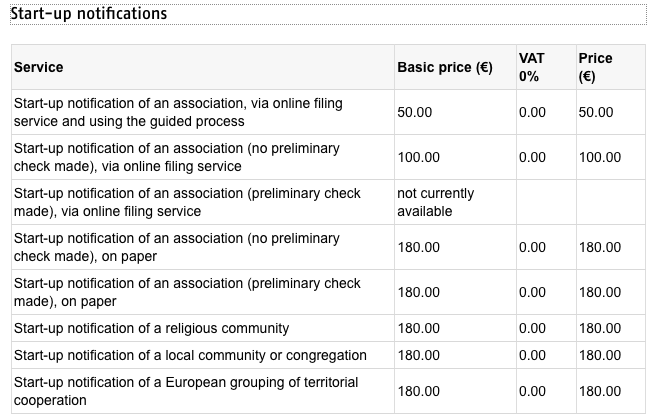

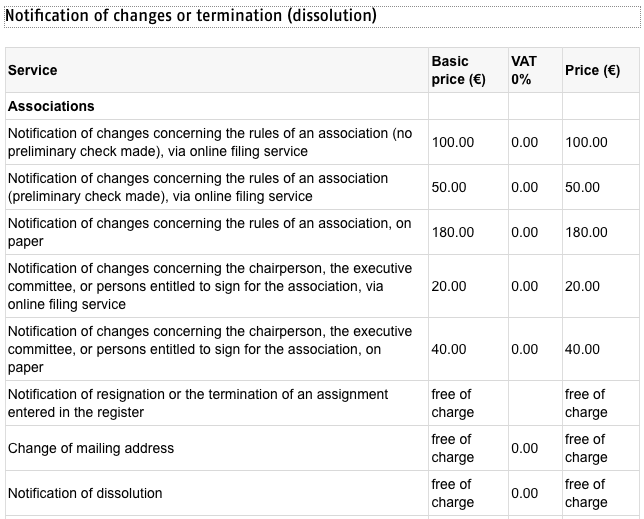

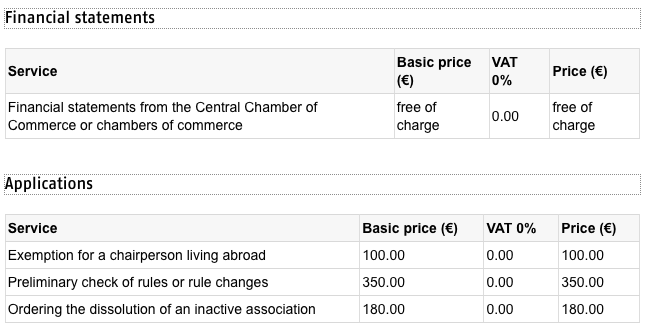

The administrative cost for registration of an association varies between 50 EUR and 180 EUR (depending of the type of association and the type of registration - paper/online).

According to the Associations Act, “Decisions of an association shall be made by its members. The rules may nevertheless lay down that decisions shall, in a manner to be specified below, be made by: 1. delegates of the association; 2. private individuals who are members of the association or of associations either direct or indirect members thereof, in a federation vote.”7

If the association has been registered in accordance with the provisions of the Associations Act, it can obtain rights, make commitments and appear before a court or other authority as a party8. Therefore, only registered associations have legal personality.

An association is only allowed to practice a trade or other economic activity that has been established in its Statute or that otherwise relates to the realization of its purpose or that is deemed economically insignificant.9

The following income is tax-exempt for non-profit associations: income from lotteries, sales events, sports competitions, dance or other recreational events, collection of items and other comparable activities or food service and sales during such event organized by an association; income from membership magazines and other publications; income from the sale of petitions, badges, greeting cards, pennants and similar, and others.10

As of January 2022, there are a total of 107 733 associations, including chambers of commerce, in Finland.11 In 2017, 54% of the population aged 10 and over participated in the activities of an association.12 The third sector (including associations and foundations, accounts for 3 - 7% of the gross domestic product (GDP) in Finland (estimated for 2019).

Table of Contents

1.Definition, types of associations and characteristics 5

2. Sources of law founding associations 6

3. Formation requirements and constitutive acts and elements 6

4. Registration requirements 7

8. Definitions of public interest 11

10 Economic activities permitted 13

11.Governance, operating rules and bodies 13

13.Reporting and transparency 16

14.Resources and assets management 17

1.Number of associations existing in each Member States 20

6.Share between voluntary and paid work 22

7.Data on cross-border activities 22

In Finland, associations are governed by the Associations Act.13 Under the Associations Act, an association can be founded for the common realisation of a non-profit purpose and that purpose cannot be contrary to law or proper behaviour.14 An association is only allowed to practice a trade or other economic activity that has been established in its bylaws or that otherwise relates to the realization of its purpose or that is deemed economically insignificant.15 Some common examples of non-profits associations include:

cultural and social associations and charitable organizations

entertainment associations, athletic clubs, and hobby clubs

trade associations

political parties.

Associations Act does not apply to “a corporation whose purpose is to attain profit or other direct financial benefit for a member or whose purpose or activities otherwise are primarily financial”16, but it does apply to “a corporation which has been founded by statute for a special purpose only if specifically so provided.”17 Latter is called a public association18.

There are registered and unregistered associations in Finland. Registration is optional, but only a registered association can obtain rights, make commitments and appear before a court or other authority as a party. Also, members of registered association are not personally liable for the commitments of the association.19 Unregistered associations, on the other hand, cannot acquire rights or undertake obligations nor sue or be sued in their own name. In addition, liability for actions made on behalf of an unregistered association rests with the persons involved in the act or decided on it personally and jointly and severally.20 Liability is therefore individual and shared.

As the supreme source of law, the Constitution of Finland21 guarantees everyone the freedom of association that includes the right to form an association without a permit, to be a member or not to be a member of an association and to participate in the activities organized by an association. Freedom to form trade unions and to organise in order to look after other interests is also guaranteed.”22

Main source of law regarding associations in Finland, and subordinate to the Constitution, is the Associations Act23, that specifically states “associations are governed by this Act.”24

Under the Associations Act, an association can be founded for the common realisation of a non-profit purpose and that purpose cannot be contrary to law or proper behavior.”25

To form an association, a charter must be drawn, and the statute of the association must be annexed thereto. 26The charter must also be dated and signed by three or more persons joining the association. A natural person as a founder must be 15 years of age or over.27 Below is a model charter that the Finnish Patent and Registration Office recommends using, when filing for registration:

“Memorandum of Association

We, the undersigned, have formed an association called _____________, joined it and approved the following rules for it.

Place, date and signatures of at least three members with their names.”28

The statute of an association must include the following:

” the name of the association;

the municipality in Finland where the association is based (the domicile of the association);

the purpose and forms of activity of the association;

any obligation of the member to pay membership and other fees to the association;

the number, or the minimum and maximum number, of the members of the executive committee, the auditors and the operations inspectors, and their term of office;

the accounting period of the association;

the time for electing the executive committee, the auditors and the operations inspectors, and for adopting the annual accounts and deciding on discharging from liability for the accounts;

the manner in which and the period within which a meeting of the association shall be convened; and

the manner in which the assets of the association shall be used if the association is dissolved or terminated.”29

After an association has been founded, it is optional to register it at the Finnish Register of Associations30.

Under the Associations Act, a notice for the registration (basic notice31) must be filed in writing with the Finnish Patent and Registration Office.32

The basic notice, “which shall be accompanied by the charter and the statute, shall give the full name, address, domicile and personal identity code of the chairperson of the association's executive committee and of the person authorised to sign the name of the association as well as a limitation concerning the right to sign the name of the association, referred to in section 36, subsection 3, if any. If such a person has no Finnish personal identity code, his or her date of birth shall be given. All other members of the executive committee may also be listed in the Basic Notice.33

The chairperson of the executive committee of the association or another competent member of the executive committee, entered in the register, signs the notice and gives affirmation that the provisions of the Associations Act are complied with when establishing the association.34

The basic notice must include the charter in Finnish or in Swedish as well as details of the persons filing.35 The notice for registration can be filed online36 in Finnish or in Swedish by using a guided process or by attaching the associations rules to the notice. A charter in Finnish or in Swedish and the details of the persons filing must be included in order to file the notice.37

The Register of Associations is maintained by the Finnish Patent and Registration Office, and the register, with related documents, is available to the general public. Anyone has the right to obtain extracts and certificates from the register and the related documents in a manner prescribed in the Finnish Act on the Openness of Government Activities.38

Register extracts with details of, for example, persons entitled to sign for the association, can be purchased in the online Information Service of the Finnish Register of Associations. Is it also possible to purchase association rules registered in the register since 2011.39

The online information service of the Finnish Register of Associations40 also provides free of charge access to basic details of associations, such as the name of the association, its business ID and the municipality the association is based in. It is also free to check the processing stage of a notification filed with the register.41

Source: Finnish Patent and Registration Office42

Source: Finnish Patent and Registration Office43

Source: Finnish Patent and Registration Office44

If an association has been registered in the Finnish Register of Associations, members of such association are not personally liable for the commitments of the association.45 Therefore, liability falls on the association.

If, however, an association is unregistered, “liability for an obligation caused by an act on behalf of an unregistered association rests with the persons who took part in the act or decided on it personally jointly and severally. Other members of the association shall not be personally liable for such obligation.46 Contrary to registered associations, unregistered ones cannot acquire rights or undertake obligations, nor sue or be sued in its own name.

A member of the executive committee, an official of an association and an operations inspector are liable to compensate all damage they have caused to the association either wilfully or negligently. The same applies to damage caused to any member of the association or a third party by an act against the Associations Act or the rules of the association. The liability in damages of an employee is governed by specific provisions.47

If the association has been registered in accordance with the provisions of the Associations Act, it can obtain rights, make commitments and appear before a court or other authority as a party48. Therefore, only registered associations have legal personality. Legal personality is acquired upon registration.

In the Finnish legal system, the concept of non-profit equals public interest.

Associations are considered non-profits, if a) they act exclusively and solely for the public good, b) their activities are not only limited to a specific group of people, and c) participants in activities do not receive any financial benefits, such as dividends, profits or unreasonably high wages.49

The conditions above must all be met simultaneously for an association to be deemed as acting for the common good. This is assessed based on both the statutes and the actual activity of an association. In that case, both the statutes and the actual activities must satisfy the conditions.

The activities of a non-profit association must be useful and general in nature. In assessing whether an association is acting in the public interest, it is necessary to ask what are the interests the associations is promoting. An association cannot be a non-profit and act for the public good if its objectives are, e.g., to raise funds or minimize costs and the activities are limited to a small and closed group of people.50

The Constitution of Finland guarantees freedom of association to everyone. It therefore does not distinguish between Finnish people and others. However, foreigners not residing in Finland are banned from being members of associations founded to influence state affairs.51 A person wishing to join an association must inform the association of his intention. Admission is then decided by the executive committee, unless stated otherwise in the association’s rules.52

According to the Associations Act, private individuals, corporations and foundations can be members of associations.53A list of members with their full name and domicile must be kept by the executive committee.54

A member is entitled to resign from an association at any time by informing the executive committee or its chairperson in writing.55 A member can be expelled by the association on a ground stated in the rules. Nevertheless, “the association invariably has the right to expel a member, who:

has failed to fulfil the obligations to which he or she has committed himself or herself by joining the association;

by his or her action within or outside the association has substantially damaged the association; or

no longer meets the conditions for membership laid down by law or the rules of the association.”56

As stated in the Associations Act, an association can only practice trade or other economic activity in three cases: if it has been provided for in its statutes, if it otherwise relates to the realization of its purpose, or if it is deemed economically insignificant.57

According to the Associations Act, “Decisions of an association shall be made by its members. The rules may nevertheless lay down that decisions shall, in a manner to be specified below, be made by:

1. delegates of the association;

2. private individuals who are members of the association or of associations either direct or indirect members thereof, in a federation vote.”58

The two main bodies of an association are the Members’ Meeting (General Assembly) and the Executive Committee.

Members exercise this power of decision at the meetings of the association59 that must be organized at a date determined by the association’s rules. If a meeting has not been convened, each member of the association has the right to demand that a meeting be held.60

Certain matters must be decided on by a meeting of the association or, if so provided for by the rules, a meeting of the delegates. These include:

“Any amendments to the rules of the association;

assignment or mortgaging of real estate or assignment of other property of significance to the activities of the association;

voting and election rules referred to in section 30;

election or expulsion of the executive committee or its member, or an auditor or an operations inspector;

adoption of the annual accounts and discharging from liability for the accounts; and

dissolution of association.”61

The rules can include a provision that, instead of meeting of the association, the executive committee can decide on selling, exchanging or mortgaging property of the association. 62

Under the Associations Act, an association must also have an Executive Committee that consists of no less than three members. The executive committee must carefully attend to the affairs of the association in compliance with the law, the rules, and the resolutions adopted by the association. The executive committee also sees to it that the association’s bookkeeping conforms to the law and that the association’s financial management has been organized in a reliable manner. The association is represented by the executive committee.63

The Executive Committee must have a chairperson, who cannot be a person lacking legal competence. Other members of the Executive Committee must be 15 years of age or more. A person who is bankrupt cannot serve as a member of the Executive Committee. The chairperson must reside in Finland, unless an exception is granted of this provision by the Finnish Patent and Registration Office.64

The registration authority in Finland can order an association to be deregistered if at least twenty years have passed since the filing of the latest notice to the Register of Associations, and there is otherwise no reason to assume the activities of an association will continue.65

In addition to the deregistration, the registration authority has the power to can order, either on its own initiative or based on an application, an association dissolved if the association does not have a competent Executive Committee chairperson entered in the register. Such an order must be issued unless it is proven, before the matter is resolved, that there are no longer grounds thereto. In any case, the association must be heard before the order is issued.66

The court of first instance of the municipality where the association is based can declare the association terminated based on an action brought by a prosecutor, the Finnish National Police Board, or a member of the association:

“If the association acts substantially against law or good practice;

if the association acts substantially against the purpose defined for it in its rules; or

if the association acts in violation of the permission referred to in section 4 or the provision of section 35(3).”67

An association may be cautioned instead of being terminated, if the public interest does not require termination. 68

Associations Act contains provision on the audit and operations inspection of an association. Audit of an association is governed by the provisions of Associations Act and the Finnish Auditing Act.69

There are certain restrictions on who can act as an auditor. According to the Auditing Act, an auditor cannot be a person for whom a guardian has been appointed, whose competence or legal capacity has been restricted, who is in bankruptcy or who has been barred from conducting business. Additionally, if one or several natural persons are appointed as auditors, at least one of them must be a resident in an EEA state.70

For each financial year, an auditor must issue a dated and signed audit report. The audit report must contain an opinion on:

whether the financial statements give a true and fair view, in accordance with the applicable financial reporting framework, of the result of operations and the financial position of the corporation or foundation;

whether the financial statements comply with statutory requirements;

whether the applicable provisions have been complied with in the preparation of the management report;

whether the information included in the management report for the financial year is consistent with the information included in the financial statements.71

The opinion of the auditor may be unqualified, qualified or adverse. If the auditor is unable to express an audit opinion, a disclaimer of opinion must be contained in the audit report.72

If the association does not have an auditor, it must have an operations inspector.73 The operations inspector must inspect the finances and the administration of the association to the extent required by the association’s operations and submit an operations inspector's report in writing to the meeting of the association or the meeting of delegates deciding on the annual accounts. The operations inspector must make a note in the report if the inspection shows that damage has been caused to the association, or if Associations Act or the rules of the association have been violated.74

Activities of non-profit associations often consist of tax-exempt non-profit activities, tax-exempt fund-raising, taxable business activities, and real estate income. Non-profits gain income from membership fees, dividends, interest, donations, and subsidies received for non-profit activities.

An association can only practice a trade or other economic activity that has been provided for in its rules or that otherwise relates to the realization of its purpose or that is to be deemed economically insignificant.75 The rules of an association must determine, inter alia, any obligation of a member to pay membership and other fees to the association.76

The Executive Committee “shall see to it that the association’s bookkeeping conforms to the law and that its financial management has been organized in a reliable manner.77

The purpose of the liquidation measures is to establish the financial standing of the association, to convert the necessary assets into money, to pay off any debts and to spend the remaining assets in accordance with the provisions laid down in the rules of the association and in the Associations Act.78

Under the Associations Act, “when a meeting of the association has decided to dissolve the association, the Executive Committee must attend to the liquidation measures caused by the dissolution referred to in subsection 2, unless the meeting of the association has appointed one or more other liquidators for the task to replace the Executive Committee. However, liquidation measures are unnecessary if, upon deciding on dissolution, the meeting of the association has simultaneously approved a final account, drawn up by the Executive Committee, according to which the association has no debts.”79

Regardless whether there were any liquidation measures or not, the association is regarded as dissolved when an entry to this effect has been made in the Finnish Register of Associations.80

Decisions of an association are made by its members81, who exercise their power of decision at the meetings of the association82.

There are Certain matters must be decided on by a meeting of the association or, if so provided for by the rules, a meeting of the delegates. These include:

“any amendments to the rules of the association;

assignment or mortgaging of real estate or assignment of other property of significance to the activities of the association;

voting and election rules referred to in section 30;

election or expulsion of the Executive Committee or its member, or an auditor or an operations inspector;

adoption of the annual accounts and discharging from liability for the accounts; and dissolution of association.”83

The rules of an association can, however, include a provision that the Executive Committee can decide on selling, exchanging or mortgaging property of the association.84

There are also certain rules regarding voting. Unless prescribed otherwise in the rules, every member over 15 years of age has the right to vote and every member entitled to vote has one vote.85 The motion to be carried by the association, unless stated otherwise in the association’s rules, is:

“the motion supported by more than half of the votes cast;

in the case of a tie, the motion supported by the chairperson of the meeting, or, if the decision is taken without a meeting in separately organized votes, by post or using data connection or some other technical means, the result obtained by drawing lots; and

in a case relating to amendment of the rules, dissolution of the association or assignment of the main part of the association’s property, the motion supported by at least three quarters of the votes cast.”86

Under the Finnish Income Tax Act87, an organization, such as association or foundation, can only be a non-profit organization if:

it acts exclusively and solely for the public good;

its activities are not only limited to a specific group of people:

participants in activities do not receive any financial benefits, such as dividends, profits or unreasonably high wages.88

If the association is deemed as non-profit, the following income is tax-exempt:

income from lotteries, sales events, sports competitions, dance or other recreational events, collection of items and other comparable activities or food service and sales during such event organized by an association;

income from membership magazines and other publications;

income from the sale of petitions, badges, greeting cards, pennants and similar;

income from products or services made during care, handicraft activities or for educational purposes at a hospital, prison, senior home, rehabilitation institute or other similar institute;

income from bingo games.89

Some of the income non-profit associations generate is subject to tax. They pay income tax on income received from business activities and income received from a real estate unit, if the real estate unit has been used for purposes other than general or non-profit activities.90

As of January 2022, there were a total of 107 733 associations, including chambers of commerce, in Finland.91

In 2017, 54% of the population aged 10 and over participated in the activities of an association.92

Associations can be divided into different categories based on their area of activities.

| Area of activity | Number of associations |

|---|---|

| Not classified | 31,143 |

| Culture | 18,998 |

| Sports and exercise | 14,497 |

| Profession and trade | 10,730 |

| Leisure | 10,287 |

| Social and Health | 6,650 |

| Other | 6,426 |

| Political | 4,537 |

| National defense | 2,068 |

| Religion | 1,409 |

Table 1: Areas of activities covered by the associations in Finland 2021

Source: Draft government proposal 2021.93

Below is a chart on tax and revenue information covering associations in Finland (2019). It does not cover associations with only tax-exempt income and associations that do not file for taxes.94

Table 2: Taxes and revenues of the associations in Finland 2019

| Revenues | Number of associations | Revenues combined (€) |

Income tax revenues combined (€) |

Tax withholding combined (€) |

Value-added tax combined (€) |

|---|---|---|---|---|---|

| 0-10,000 | 4,693 | 14,062,431 | 671,396 | 16,428,606 | 3,413450 |

| over 10,0000 – 30,000 | 2,683 | 49,018,818 | 248,859 | 1,110,269 | 78,923 |

| Over 30,000 | 6,395 | 5,300,887,833 | 10,464,309 | 333,085,751 | 66,729,476 |

Source: Draft government proposal.95

The third sector, such as associations and foundations, accounts for 3 - 7% of the gross domestic product (GDP) in Finland (estimated for 2019).

According to the latest statistical data available from 2017, 28% of the population aged 10 and more had volunteered for an association, club or group in the last 12 months.96

According to the latest statistical data available from 2020, employees of associations amounted to 41 000 full-time equivalent;97 that is, all paid hours of an association are divided by the average paid hours of full-time wage and salary earners of the association concerned.

The Finish Patent and Registration Office do not have any data on cross-border activities.

Act on the Openness of Government Activities 21/1999. https://www.finlex.fi/fi/laki/ajantasa/1999/19990621

Associations Act 503/1989. https://www.finlex.fi/fi/laki/ajantasa/1989/19890503

Auditing Act 1141/2015. https://www.finlex.fi/fi/laki/ajantasa/2015/20151141

Constitution of Finland 731/1999. https://www.finlex.fi/fi/laki/ajantasa/1999/19990731?search%5Btype%5D=pika&search%5Bpika%5D=perustuslaki

Income Tax Act 1535/1992. https://www.finlex.fi/fi/laki/ajantasa/1992/19921535?search%5Btype%5D=pika&search%5Bpika%5D=tuloverolaki

Universities Act 558/2009. https://www.finlex.fi/fi/laki/ajantasa/2009/20090558?search%5Btype%5D=pika&search%5Bpika%5D=yliopistolaki

Communal Civil Activities in the 2020s. Draft Government Proposal to Amend the Associations Act and the Action Group Act. Available at: https://julkaisut.valtioneuvosto.fi/bitstream/handle/10024/162854/OM_2021_8_ML.pdf?sequence=1&isAllowed=y

Finnish Patent and Registration Office(a). https://www.prh.fi/fi/index.html

Finnish Patent and Registration Office(b). https://www.prh.fi/en/yhdistysrekisteri/perustaminen/start-up_notification.html

Finnish Patent and Registration Office(c). https://www.prh.fi/en/yhdistysrekisteri/register_extracts_rules_and_other_details.html

Finnish Patent and Registration Office(d). https://www.prh.fi/en/yhdistysrekisteri/hinnasto/kasittelymaksut.html

Finnish Patent and Registration Office(e). https://www.prh.fi/en/yhdistysrekisteri/statistics/numberofassociationsandreligiouscommunities.html

Finnish Patent and Registration Office(f). https://www.prh.fi/fi/yhdistysrekisteri/yhdistyksen_perustajalle/yhdistyksen_perustamisilmoitus/perustamiskirja.html

Finnish Register of Associations. https://yhdistysrekisteri.prh.fi/?userLang=fi

Finnish Tax Agency. Tax Guide for Non-profit organizations.

https://www.vero.fi/syventavat-vero-ohjeet/ohje-hakusivu/47999/verotusohje-yleishy%C3%B6dyllisille-yhteis%C3%B6ille3/

Halila, Heikki – Tarasti, Lauri. Yhdistysoikeus (Association Law). 4th edition. Talentum 2011.

Information Service of the Finnish Register of Associations. https://yhdistysrekisteri.prh.fi/?userLang=fi

Official Statistics of Finland. Leisure Participation 2017. Available at:

https://tilastokeskus.fi/til/vpa/2017/vpa_2017_2018-08-30_fi.pdf

Statistics Finland. https://pxnet2.stat.fi/PXWeb/pxweb/fi/StatFin/StatFin__yri__yrti__voi/statfin_yrti_pxt_11i1.px/table/tableViewLayout1/

Associations Act 503/1989, section 1, subsection 2. It is worth noting, however, that the Associations Act is currently subject to amendments; there is a draft version of the Government’s proposal to reform the Associations Act and enact a new Action Group Act. The draft version of the proposal proposes several amendments to the Associations Act, such as allowing a statutory (based on the rules of the association) CEO body, facilitating the amalgamation of associations, and allowing member and federation voting in the election of the board. Additionally, facilitating remote participation in the associations meeting and allowing online meeting are also on the list of proposed amendments. Other suggested proposals include, e.g., new and clarified provisions on the requirement of equal treatment of members, right of members to ask questions at the association’s meeting, and the disqualification of a member of a board. In addition, the new Action Group Act would apply to the civil activities lesser than an association, and the action group would have a new legal personality. Finally, more lenient accounting requirements are proposed for associations and activity groups with less financial activity.↩︎

Associations Act, section 1, subsection 1.↩︎

Constitution of Finland 731/1999↩︎

Constitution of Finland, section 13, subsection 2. However, the right to form an association is not without an exception; under Associations Act sections 3 and 4, military organized associations are forbidden, and associations whose activities include training in the use of firearms and whose sole purpose is not hunting, are subject to permission. Also, constitutional membership rights (the right to join and the right not to join) have some restrictions, too. According to the Associations Act section 12, admission of members is decided by the Executive Committee, unless rules of the association lay down otherwise. Furthermore, membership in some public associations is obligatory. For example, the Finnish Universities Act 558/2009 section 46 states that “All university students who have been admitted to programmes leading to a Bachelor’s or Master’s degree, with the exception of students in commissioned education, belong to the student union.”↩︎

Associations Act 503/1989↩︎

Associations Act, section 1, subsection 2.↩︎

Associations Act, section 16.↩︎

Associations Act, section 6, subsection 1.↩︎

Associations Act, section 2, subsection 5.↩︎

Income Tax Act, section 23, subsection 3↩︎

Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/statistics/numberofassociationsandreligiouscommunities.html↩︎

Official Statistics of Finland. Leisure Participation 2017, p. 6.↩︎

Associations Act 503/1989, section 1, subsection 2. It is worth noting, however, that the Associations Act is currently subject to amendments; there is a draft version of the Government’s proposal to reform the Associations Act and enact a new Action Group Act. The draft version of the proposal proposes several amendments to the Associations Act, such as allowing a statutory (based on the rules of the association) CEO body, facilitating the amalgamation of associations, and allowing member and federation voting in the election of the board. Additionally, facilitating remote participation in the associations meeting and allowing online meeting are also on the list of proposed amendments. Other suggested proposals include, e.g., new and clarified provisions on the requirement of equal treatment of members, right of members to ask questions at the association’s meeting, and the disqualification of a member of a board. In addition, the new Action Group Act would apply to the civil activities lesser than an association, and the action group would have a new legal personality. Finally, more lenient accounting requirements are proposed for associations and activity groups with less financial activity.↩︎

Associations Act, section 1, subsection 1.↩︎

Associations Act, section 2, subsection 5.↩︎

Associations Act, section 2, subsection 1.↩︎

Associations Act, section 2, subsection 2.↩︎

In addition to categorizing associations into non-profit and economic associations, or public and private associations, associations can also be divided into groups of four: 1) private non-profit associations, 2) public non-profit associations, 3) private economic associations, and 4) public economic associations. See Halila – Tarasti 2011, p. 23.↩︎

Associations Act, section 6.↩︎

Associations Act, section 58.↩︎

Constitution of Finland 731/1999↩︎

Constitution of Finland, section 13, subsection 2. However, the right to form an association is not without an exception; under Associations Act sections 3 and 4, military organized associations are forbidden, and associations whose activities include training in the use of firearms and whose sole purpose is not hunting, are subject to permission. Also, constitutional membership rights (the right to join and the right not to join) have some restrictions, too. According to the Associations Act section 12, admission of members is decided by the Executive Committee, unless rules of the association lay down otherwise. Furthermore, membership in some public associations is obligatory. For example, the Finnish Universities Act 558/2009 section 46 states that “All university students who have been admitted to programmes leading to a Bachelor’s or Master’s degree, with the exception of students in commissioned education, belong to the student union.”↩︎

Associations Act 503/1989↩︎

Associations Act, section 1, subsection 2.↩︎

Associations Act, section 1, subsection 1.↩︎

The charter is the initial document prepared before the elaboration of the Statutes which covers the functioning of the association.↩︎

Associations Act, section 7.↩︎

Finnish Patent and Registration Office,

https://www.prh.fi/fi/yhdistysrekisteri/yhdistyksen_perustajalle/yhdistyksen_perustamisilmoitus/perustamiskirja.html↩︎

Associations Act, section 8. In the draft government proposal, paragraphs from 4 to 9 are proposed to be repealed and association’s rules should only specify the name, municipality, and the purpose of the association. See draft government proposal, p. 160.↩︎

Finnish Register of Associations, https://yhdistysrekisteri.prh.fi/?userLang=fi↩︎

Also called as start-up notification.↩︎

Associations Act, section 48, subsection 1. Finnish Patent and Registration Office, https://www.prh.fi/fi/index.html↩︎

Associations Act, section 48, subsection 2. A reference to the disclosure of information about a potential chief executive officer (CEO) in the basic notice is proposed to be added to subsection 2. See draft government proposal, p. 202.↩︎

Associations Act, section 48, subsection 3. It is proposed that the obligation to sign the basic notice and provide the affirmation would also be extended to the potential CEO. See draft government proposal, p. 202.↩︎

Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/perustaminen/start-up_notification.html. To file, the Finnish personal identity codes of the chairperson and other persons entitled to sign for the association are needed. Also, if the Executive Committee is filed for registration, the details on the personal identity codes of the committee members are required. If a committee member or a person entitled to sign for the association has no Finnish personal identity code, their date of birth, citizenship, and home address are needed along with a copy of their passport or identification document.↩︎

In case the Patent and Registration Office has already reviewed the rules of an association, registration notice is filed by paper forms. See Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/perustaminen/start-up_notification.html↩︎

Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/perustaminen/start-up_notification.html. To file, the Finnish personal identity codes of the chairperson and other persons entitled to sign for the association are needed. Also, if the Executive Committee is filed for registration, the details on the personal identity codes of the committee members are required. If a committee member or a person entitled to sign for the association has no Finnish personal identity code, their date of birth, citizenship, and home address are needed along with a copy of their passport or identification document.↩︎

Associations Act, section 47.↩︎

Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/register_extracts_rules_and_other_details.html↩︎

Information Service of the Finnish Register of Associations, https://yhdistysrekisteri.prh.fi/?userLang=fi↩︎

Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/register_extracts_rules_and_other_details.html↩︎

Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/hinnasto/kasittelymaksut.html↩︎

Finnish Patent and Registration Office,

https://www.prh.fi/en/yhdistysrekisteri/hinnasto/kasittelymaksut.html↩︎

Finnish Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/hinnasto/kasittelymaksut.html↩︎

Associations Act, section 6, subsection 2.↩︎

Associations Act, section 58.↩︎

Associations Act, section 39, subsection 1. It is proposed to amend the subsection 1 so that, inter alia, the CEO would also be liable for damages. See draft government proposal, p. 191.↩︎

Associations Act, section 6, subsection 1.↩︎

Income Tax Act, chapter 3, section 22, subsection 1.↩︎

Finnish Tax Agency,

https://www.vero.fi/syventavat-vero-ohjeet/ohje-hakusivu/47999/verotusohje-yleishy%C3%B6dyllisille-yhteis%C3%B6ille3/↩︎

Associations Act, section 10, subsection 2.↩︎

Associations Act, section 12.↩︎

Associations Act, section 10, subsection 1.↩︎

Associations Act, section 11, subsection 1.↩︎

Associations Act, section 13. A member is also entitled to resign by giving a notice at a meeting of the association for entry in the minutes. It is proposed in the draft government proposal that an explicit provision should be added, for the sake of clarity, that the board may decide that the notice of resignation may be received by a party other than the board and that the notice may be given by other means than in writing. See draft government proposal, p. 169.↩︎

Associations Act, section 14.↩︎

Associations Act, section 5.↩︎

Associations Act, section 16.↩︎

Associations Act, section 17, subsection 1. In the draft government proposal, it is proposed to amend the section, i.e., so that in addition to the traditional meeting, the meeting of the association may, under certain conditions, be held online with no physical meeting place and that the meeting can only be attended online. See draft government proposal, p. 169.↩︎

Associations Act, section 20.↩︎

Associations Act, section 23, subsection 1. It is proposed in the draft government proposal to add a new paragraph 7 to subsection 1 regarding decision-making on mergers. See draft government proposal, p. 171.↩︎

Associations Act, section 23, subsection 2.↩︎

Associations Act, section 35, subsection 1. It is proposed in the draft government proposal that three to seven members should be elected to the board. See draft government proposal, p. 180.↩︎

Associations Act, section 35, subsection 2 and 3.↩︎

Associations Act, section 41a, subsection 1.↩︎

Associations Act, section 41a, subsection 4.↩︎

Associations Act, section 43, subsection 1.↩︎

Associations Act, section 43, subsection 2.↩︎

Associations Act, section 38.↩︎

Auditing Act, chapter 2, section 1.↩︎

Auditing Act, chapter 3, section 5, subsection 2.↩︎

Auditing Act, chapter 3, section 5, subsection 3.↩︎

Associations Act, section 38 a, subsection 1.↩︎

Associations Act, section 38 a, subsection 4.↩︎

Associations Act, section 5.↩︎

Associations Act, section 8, paragraph 4.↩︎

Associations Act, section 35, subsection 1.↩︎

Associations Act, section 40, subsection 2.↩︎

Associations Act, section 40, subsection 1.↩︎

Associations Act, section 40, subsection 5.↩︎

Associations Act, section 16. The rules may nevertheless state that decisions are made by:

delegates of the association; private individuals, who are members of the association or of associations either direct or indirect members thereof, in a federation vote.↩︎

Associations Act, section 17, subsection 1. Members can make decisions, which must be made at the meeting of the association, without holding a meeting provided members are unanimous. The decision must be in writing, dated and signed by the members of the association. Otherwise, the provisions concerning the records kept at the meeting of the association, apply to a decision in writing. See Associations Act, section 17, subsection 4.↩︎

Associations Act, section 23, subsection 1.↩︎

Associations Act, section 23, subsection 2.↩︎

Associations Act, section 25, subsection 1.↩︎

Associations Act, section 27, subsection 1.↩︎

Income Tax Act 1535/1992↩︎

Income Tax Act, section 22, subsection 1.↩︎

Income Tax Act, section 23, subsection 3↩︎

Income Tax Act, section 23, subsection 1.↩︎

Patent and Registration Office, https://www.prh.fi/en/yhdistysrekisteri/statistics/numberofassociationsandreligiouscommunities.html↩︎

Official Statistics of Finland. Leisure Participation 2017, p. 6.↩︎

Draft government proposal, p. 18.↩︎

Draft government proposal, p. 19.↩︎

Draft government proposal, p. 19.↩︎

Official Statistics of Finland. Leisure Participation 2017, p. 10.↩︎

Statistics Finland, https://pxnet2.stat.fi/PXWeb/pxweb/fi/StatFin/StatFin__yri__yrti__voi/statfin_yrti_pxt_11i1.px/table/tableViewLayout1/↩︎