Comparative legal analysis of associations laws and regimes in the EU. Country Report: Croatia

EXECUTIVE SUMMARY

According to Article 4 of the Law on Associations1, an association is any form of free and voluntary association of natural or legal persons. The founders of an association establish it to protect their interests or advocate for the protection of human rights and freedoms, protection of the environment and nature and sustainable development, and for humanitarian, social, cultural, educational, scientific, sports, health, technical, informative, professional or other beliefs and purposes that are not contrary to the Constitution and the law and without the intention to gain profit or other economically measurable benefits.

The establishment of associations in the Republic of Croatia is prescribed, above all, in the Constitution2. In addition to the Constitution, in the Croatian legislation as a lex specialis3 in the field of associations, the Law on Associations4 stands out as a key legal act.

The association established in the Republic of Croatia and duly registered in the Register of Associations of the Republic of Croatia, acquires legal personality on the day of their registration in the Register of Associations.

Associations are governed by the General Assembly with the assistance of the official representative authorized to act on behalf of the organization.

The administrative cost for establishing an association is as follows: the first cost is an administrative cost of EUR 9.30. After receiving the decision for registration in the Register of Associations, they should pay for a stamp from EUR 19.94 to EUR 33.23. After obtaining the stamp, it is necessary to send a request to the Central Bureau of Statistics for entry in the Register of Business Entities. The request should be accompanied by a payment of EUR 7.31.

Associations in the Republic of Croatia are allowed to carry out economic activities only if they do not intend to make a profit for their members or third parties.

An association that is a taxpayer of profit tax is obliged to pay that tax only for the profit it realizes from economic activities. Income tax is calculated and paid at a rate of 20% on the established tax base.

According to the Register of Associations of the Republic of Croatia, at the end of January 2022, the total number of associations in the Republic of Croatia was 52,340. The estimated minimum number of members of associations in 2022 was 150 000 people5.

In 2018, the total revenues of associations were EUR 887,492,865.00, while the total expenditures were EUR 900,656,113. In 2019, the economic weight of associations in Croatia was 1.7%.

According to the data of the Register of Foreign Associations, a total of 207 foreign associations are currently registered, of which 149 are active.

1. Definition, types of associations and characteristics

2. Sources of law founding association

3. Formation requirements and constitutive acts and elements

8. Definitions of public interest

10. Economic activities permitted

11. Governance, operating rules and bodies

13. Reporting and transparency

14. Resources and assets management

6. Share between voluntary and paid work

The establishment of associations in the Republic of Croatia is prescribed, above all, in the Constitution6. The Constitution7, as the highest and most important general legal act, is the basis on which the foundations of the state and law are laid. Thus, the Constitution of the Republic of Croatia in its Article 43 stipulates that: “Everyone is guaranteed the right to freedom of association to protect their interests or to achieve social, economic, political, national, cultural or other beliefs and goals”. Therefore, everyone is free to form, join or withdraw from trade unions and other associations by law. The right to free association is limited by the prohibition on violent endangerment of the democratic constitutional order, as well as the independence, unity and territorial integrity of the Republic of Croatia. Additionally, although according to Article 43 of the Constitution of the Republic of Croatia it is quite clear that everyone has the right and freedom of association, still the legislator in Article 63 re-emphasizes the right of association of employees and employers, except in the armed forces and police where that the trade union organization may be restricted by law.”

From the adoption of the Constitution of the Republic of Croatia in 1990 until today, this article which refers to the establishment of associations has undergone minor changes.

Namely, in the basic text of the 1990 Constitution, Article 43 paragraph 1 allows, in addition to the formation of trade unions and other associations, the formation of political parties. This concept was abandoned in the amendment to the Constitution from 2020.

In addition, the original text of the Constitution stipulates that "citizens" have a guaranteed right to freedom of association, so that later, in the amendment to the Constitution from 2001, the word "citizens" is replaced by the word "everyone" achieving the broadest notion of freedom and right (this means that residents who have not acquired the status of citizens in the Republic of Croatia have been entitled to freedom of association since 2001).

According to the current legislation of Croatia8, an association is any form of free and voluntary association of natural or legal persons. The founders of an association establish it to protect their interests or advocate for the protection of human rights and freedoms, protection of the environment and nature and sustainable development, and for humanitarian, social, cultural, educational, scientific, sports, health, technical, informative, professional or other beliefs and purposes that are not contrary to the Constitution and the law and without the intention to gain profit or other economically measurable benefits. Such an association is subject to rules governing the structure and functioning of this form of association.

The Croatian legislator foresaw the definition of the characteristics of the associations in the Republic of Croatia by setting 5 important principles:

Principle of independence;

Principle of publicity;

Principle of democratic organization;

Principle of non-profit;

Principle of free participation in public life.

Each association established on the basis of the laws of the Republic of Croatia independently determines its area of activity, goals and enterprise, its internal structure and independently performs activities that are not contrary to the Constitution and the laws of the Republic of Croatia. The publicity of the work of the association is regulated in the statute of each association.

The principle of democratic organization implies that every Croatian association is governed by its members, respecting the principles of democratic representation and democratic expression of will.

Associations are not established for profit, but they can still conduct business by the law and the statute.

Finally, associations are free to participate in the development, monitoring, implementation and evaluation of public policies, as well as in shaping public opinion and to express their views, opinions and take initiatives on issues of interest.

It is important to emphasize the difference that Croatian legislation makes between associations and non-profit organizations. Namely, the notion of association based on the Law on Associations of the Republic of Croatia does not include all types of non-profit organizations.

The term non-profit organizations is a common name for various forms of organization of legal entities - associations and their unions, foreign associations, foundations, institutions, political parties, chambers, unions, religious and other communities, and all of them do not have profit as a basic goal of establishment and operation.

On the other hand, the associations according to the law as the main principle on which they should be based is non-profit, but they can make profit in certain, legally defined situations.

There are several types of associations distinguished on the basis of the pursuit of activities recognized in Croatia, such as human rights, culture, economy and others.

The establishment of associations in the Republic of Croatia is prescribed, above all, in the Constitution of the Republic of Croatia.

In addition to the Constitution, in the Croatian legislation as a lex specialis9 in the field of associations, the Law on Associations10 stands out as a key legal act in the field.

This law lays the structure for defining the term associations in the Republic of Croatia. In addition to the definition, the Law on Associations prescribes all important aspects regarding the formation of associations, the principles on which they are based, the manner of establishment, the manner of registration, property and financing, status changes, supervision and termination of their existence.

An important bylaw in the Republic of Croatia on which the legal regulation of the associations in the Republic of Croatia is based in the Rulebook on the content and the manner of keeping the register of associations of the Republic of Croatia and the Register of foreign associations in the Republic of Croatia11. This Rulebook, by Article 22 paragraph 5 of the Law on Associations, is adopted by the competent Minister of Administration.

Other laws that regulate and supplement the issue of non-profit organizations are the Law on Foundations12, the Law on Institutions13, Law on Volunteering14, Law on Financial Operations and Accounting of Non-Profit Organizations15.

From the other bylaws that regulate the matter that refers to the associations in the Republic of Croatia can be distinguished the Regulation on criteria, measures and procedures of financing and contracting of programs and projects of interest for common goods implemented by associations16.

The Law on Associations of the Republic of Croatia in its third chapter17 regulates the manner and conditions for the establishment of associations. It is prescribed that an association in the Republic of Croatia can be established by at least three founders.

Statute of the associations

All associations registered in Croatia must have their statute. The statute is a basic general act of the association that is adopted by the assembly of the association. All other general acts, if adopted by the association, must be by the statute.

Content of the stature of an Association:

The statute of the associations must contain provisions for:

name and address;

representation;

the appearance of the seal of the association;

areas of action by the objectives;

goals;

activities that achieve the goals;

economic activities by the law, if performed;

the manner of providing publicity to the activities of the association;

conditions and manner of membership and termination of membership, rights, obligations and responsibilities and disciplinary responsibility of the members and manner of keeping the list of members;

the bodies of the association, their composition and manner of convening sessions, election, revocation, authorizations, manner of decision-making and duration of the mandate and manner of convening the assembly in case of expiration of the mandate;

election and revocation of the liquidator of the association;

termination of the association;

property, manner of acquisition and disposal of the property;

procedure with property in case of termination of the association;

the manner of resolving disputes and conflicts of interest within the association.

The statute may (but does not have to) contain provisions for:

territorial activities of the association;

the logo of the association and its appearance;

other issues of importance to the association.

The Office for Associations is the special body that is responsible for all matters related to associations in Croatia. The establishment of the office for associations is done with a special legal act - Decree for performing professional activities within the Government of the Republic of Croatia, the Office for Associations18. The same decree stipulates that the Office should be headed by a director appointed by the Government on the proposal of the Prime Minister after a previously conducted public competition.

The associations in the Republic of Croatia are registered in a public register which is kept in electronic form and which is unique for all associations in the Republic of Croatia. The registration in the Register of Associations19 is voluntary and is done at the request of the person authorized to represent the association who on behalf of the founder submits a request for registration in the Register of Associations to the office of the state administration, responsible according to the address of the association. Since registration is voluntary, registration is not a precondition for an association to come into existence.

The Register of associations and the Register of foreign associations20, as well as the data entered in the register and the statute of the association are public. Anyone can get an insight into the online Register of Associations. The Register of Associations and the Register of Foreign Associations are central electronic databases kept by the competent offices only for all associations, i.e. foreign associations in the Republic of Croatia.

The general administration is responsible for the registration of an association in the Republic of Croatia. The request is submitted to the state administration at the regional unit of self-government on whose territory the headquarters of the association is or to the City administration for the general administration of Zagreb (if the association is based in Zagreb). For the registration of the association in the Register of associations, the competent administration makes a decision. The Ministry of Administration of the Republic of Croatia decides on the appeals against the decisions of these offices.

The registration of an association in the register of associations is voluntary and is done at the request of the founder of the association. The request for a record in the Register of associations, on behalf of the founder, is submitted by the person authorized to represent the association.

The application for record in the Register of associations should be accompanied by:

minutes of the work and the decisions of the founding assembly of the association;

the decision of the assembly for initiating a procedure for the record in the register of associations, if such a decision was not made at the founding assembly;

the statute of the association;

the list of founders;

personal names of the persons authorized for representation and personal name or title of the liquidator;

excerpt from the court or other register for a foreign legal entity of the founder of the association;

a copy of an ID card or passport of the founders, the liquidator and the person authorized to represent;

consent or approval of the competent body for performing a certain activity, when it is prescribed by a special law as a condition for registration of the association;

another statement or consent if required by the Law on Associations of the Republic of Croatia.

The competent body of the administration will decide on the application for registration within 30 days from the day of submitting the final application for registration. If the office of the competent body of the administration determines that the statute of the association is not compliant with the legal requirements or if the request is not accompanied by appropriate evidence, the submitter of the request will be called in a period that cannot be less than 15 days.

The decision for registration in the register of associations must contain a name, address, registration number of the association, goals and activities of the association, economic activities (if prescribed by statute), confirmation that the association acquires the status of a legal entity by registration in the register of associations, the name or title of the liquidator of the association and the names of the persons authorized to represent the association.

The appeal against the decision for the record in the register of associations does not delay the execution of the decision.

A copy of the statute of the association is certified by the competent body of the administration and submitted to the association together with the decision for the record in the Register of associations.

The decision for the registration of an association which by the statute prescribes the performance of an economic activity, the competent body of the administration submits immediately after the record in the Register of associations to the Ministry of Finance, the tax administration.

If the competent body does not decide for the record in the Register of associations within 30 days from the date of submission of the proper request, the association will be considered registered in the Register of associations the day after the deadline.

If a foreign associations needs to be registered, the request for a record in the Register is submitted by the person authorized to represent the foreign association in the Republic of Croatia.

When establishing an association in the Republic of Croatia, the founders are obliged to cover three types of administrative costs:

The first cost is an administrative cost of HRK 7021 (about EUR 9.30) which is paid for the registration of the association in the Register of associations, after the holding of the founding assembly of the association;

After receiving the decision for registration in the Register of Associations, they should pay for a stamp from EUR 19.94 to EUR 33.23 (more precisely from HRK 150 to HRK 250);

After obtaining the stamp, it is necessary to send a request to the Central Bureau of Statistics for entry in the Register of Business Entities to determine the personal identification number and classification according to the National Classification of Activities. The request should be accompanied by a payment of EUR 7.31 (about HRK 55).

The total costs of all three items range from EUR 37 to a maximum of EUR 50.

The associations established under the current laws of the Republic of Croatia are responsible for their obligations with all their property22. However, the members of the association and the members of its bodies are not responsible for the obligations of the association. If the association is damaged, or if the association has caused damage to third parties, the association and the persons authorized to represent the association for the damage are liable on the basis of the general regulations on liability for damage which applies in the Republic of Croatia.

Special requirements apply when the associations is financed by public funds. Article 34 of the Law on Associations of the Republic of Croatia contains additional clauses. If the association implements programs financed from public sources, they should inform the donor at least once a year about its work, scope, manner of acquisition and use of funds. In addition, they need to provide information for general public through the website or other appropriate means. The funds approved for this type of association should be used exclusively for the realization of the approved programs and projects, due to which they were financed.

The association established in the Republic of Croatia and duly registered in the Register of Associations of the Republic of Croatia, acquires legal personality on the day of their registration in the Register of Associations.

The management of the association is entrusted to its members, or through elected representatives in the bodies of the association, in a manner prescribed in its statute. The association appoints one or more natural persons to represent the association.

Unless otherwise provided by the statute, the person authorized to represent the association is responsible for the legality of its operation and manages the affairs of the association by the decisions of the assembly. This person is also responsible for submitting the draft annual financial report to the Assembly, and he/she is obliged to submit the minutes of the regular session of the Assembly to the competent office that maintains the register of associations.

The person authorized to represent the association may conclude agreements or undertake other legal actions on behalf of the association or other types of obligations prescribed by law, its statute or other legal acts of the association.

Associations can be united in an alliance, community, network, coordination or another form of association, regardless of their field of activity and can freely determine the name of that form of association. This form of association may have the status of a legal entity. Also, the association can have its organizational forms such as branches, clubs, etc., and such organizational forms can have the status of a legal entity if it is determined by the statute of the association, based on the decision of the authorized body of the association for each organizational form.

According to the Law on Associations of the Republic of Croatia, the status of foreign associations in the country is regulated. Thus, a foreign association is an association or another form of association established without the intention to make a profit and is legally established based on the legal order of a foreign state. A foreign association may perform its activity on the territory of the Republic of Croatia after registration in the Register of Foreign Associations in the Republic of Croatia, by special regulations that regulates the conditions for performing this type of activity. However, the foreign association does not acquire the status of a legal entity by registering in the register of foreign associations, unlike the domestic associations which, by registering in the Register of associations, acquire the status of a legal entity.

The programs and projects of interest for the common good in the Republic of Croatia implemented by the associations can be financed from the state budget, the budgets of the local and regional self-government units, the funds of the European Union and other public sources.

Special regulations may provide for tax breaks and other benefits for associations that implement programs or projects of public interest23.

Programs and projects of interest to the common good are considered to be thematically clearly defined activities that are following the values prescribed by the Constitution of the Republic of Croatia, which add social value that raises the quality of life of the individual and promotes the development of the wider social community.

The following areas are considered activities of interest for the common good:

activities of associations that contribute to the protection and promotion of human rights;

activities for protection and promotion of national minorities,

activities for protection and promotion of the rights of persons with disabilities and children with disabilities,

activities for the promotion of the rights and welfare of the elderly and infirm,

activities to promote equality and equity,

activities aimed at preserving peace and combating violence and discrimination,

activities to promote the values of the Homeland War,

activities aimed at protection, care and education of children and youth and their active participation in society,

activities for prevention and fight against all forms of addiction,

activities for the development of democratic political culture, protection and promotion of the rights of minority groups and development of volunteering, social services and humanitarian activities,

activities aimed at promotion and development of social entrepreneurship, protection of consumer rights,

activities for the protection of the environment and nature,

activities for protection and preservation of cultural goods and sustainable development,

activities for the development of the local community,

activities to encourage international development cooperation,

health care activities,

activities for development and advancement of science, education and lifelong learning,

activities in the field of culture and art,

activities from the technical and information culture,

sports activities,

activities for voluntary firefighting, search and rescue and

other activities that by their nature or with special regulations for financing the public needs in a certain area can be considered as activities of public interest.

The Government of the Republic of Croatia, at the proposal of its expert service responsible for the associations, shall issue a decree regulating the criteria, measures and procedures for financing and concluding contracts for programs and projects of interest for the common good implemented by the associations. Competent state bodies, local and regional self-government units and other public institutions finance and conclude agreements for the implementation of programs and projects of interest for the common good based on a public call or tender or based on special regulations for financing public needs.

The Decree on the criteria, measures and procedures for financing and concluding contracts for programs and projects of interest for the common good24 implemented by the associations determine the criteria, measures and procedures applied by the competent bodies of the state administration, government services and other public bodies, institutions that have funds from public sources in financing and concluding contracts for programs and/or projects of public interest. The criteria, measures and procedures of this Decree shall be appropriately applied by the units of local and regional self-government, companies owned by the Republic of Croatia, i.e. one or several units of local and regional self-government and other legal entities when they finance programs and projects of associations from public sources and donate or sponsor associations.

For this Decree, public sources mean funds from the state budget, which include earmarked funds from games of chance and funds from the budgets of counties, cities and municipalities, as well as public funds and revenues of public enterprises and other public institutions, funds of European Union and foreign public sources.

Associations that implement programs and projects of public interest that are funded by public sources must inform the donor at least once a year about their work, scope, method of acquisition and use of funds and inform the general public through the website or other appropriate means.

Any natural or legal person can become a member of the association, by the law and the statute of the association.

A member of an association can also be a minor under 14 years of age whose legal representative has given a written consent that he/she agrees with it, or a minor over 14 years of age whose legal representative gives written consent.

Each association is obliged to keep a list of its members. The list of members of the association must contain the following information about the members:

personal name or title of the legal entity;

ID number or OIB25 of the legal entity;

date of birth or date of establishment for the legal entity;

date of membership in the association;

membership category26;

if it is determined by the statute of the association to state the date of termination of membership in the association

and other information27.

This list of members must always be available for inspection by all members of the association and the competent authorities, at their request.

The statute of the association defines the conditions for admission of new members.

The members of the association have rights and responsibilities which are described as follows:

they are obliged to actively participate in the management of the association;

have the right to elect and be elected in the bodies managed by the association;

are obliged to be informed about the activities of the association;

are obliged to actively participate in the implementation of the activities and the supervision of the association;

are obliged to respect the provisions of the law and the statute of the association during the performance of the activities of the association;

if it is prescribed by the statute of the association, the members are obliged to pay the membership fee.

The founder of an association can be any legal entity or business person capable of working if he/she has not been deprived of his / her legal capacity in the part of concluding legal transactions. In case a minor who has reached the age of 14 wants to establish an association or an adult whose business capacity has been partially revoked, he/she can do so by obtaining the consent of his / her legal representative, given before the founding assembly of the association.

Any natural or legal person may become a member of an association established based on the applicable laws of the Republic of Croatia, by the law and the statute of the association. For minors to be able to be members of associations, a statement/consent from their legal representatives is required.

All the established association in the Republic of Croatia are obliged to keep a list of their members. The list of members is kept electronically or in another appropriate way and must contain data on the name, social security number, date of birth, date of membership in the association, category of membership, and the date upon the termination of membership (if determined by the statute of the association). This list may contain other information. The list of members must always be available for inspection by all members and authorities at their request.

Associations in the Republic of Croatia are allowed to carry out economic activities only if they are not aimed at making a profit for their members or third parties.

According to Article 9 of the Law on Associations of the Republic of Croatia, the activities of the association should be based on the principle of non-profitability, which means that the association is not established for profit, but can perform the economic activity by law and statute.

The provisions of the General Tax Law of the Republic of Croatia28 clarify that economic activity means the exchange of goods and services on the market to generate income, profits or other economically assessed benefits.

As prescribed by Article 31 of the Law on Associations, associations can generate income by performing activities that achieve goals defined by their statute.

The association can also perform economic activity in addition to the activities that achieve the goals set out in the statute, but cannot perform them for profit for its members or third parties.

If in the performance of the economic activity the association realizes surplus income over the expenses, they must, according to the statute of the association, be used exclusively for achieving the goals set by the statute. If this is the case, the association can perform profitable activity and generate unlimited income. The principle of non-profitability of the members and third parties does not prevent the association from covering the costs for paid workers.

The decision of registration of an associations must be submitted to the Tax Administration immediately after the entry into the register of associations. The Law on Profit Tax29 stipulates that associations that perform certain economic activity, the non-taxation of which would lead to the acquisition of unjustified market privileges, are obliged to be registered in the register of taxpayers kept by the Tax Administration. This must be done within eight days.

Associations registered in the Republic of Croatia are managed by their members, directly or through their elected representatives in the bodies of the association, in a manner prescribed by its statute.

For legal entities, the representatives of the legal entities that are members of the associations appoint the person who is authorized to represent the legal entity, unless otherwise provided by the internal act of the legal entity.

The highest body of the association is its Assembly. It consists of all members of the association or their representatives. The mandate of the elected representatives of the members in the assembly is prescribed by the statute of the association.

The assembly of the association:

adopts the statute of the association and its changes;

elects and dismisses the persons authorized to represent;

elects and dismisses other bodies of the association unless otherwise provided by the statute;

decides on associations in unions, communities, networks and other forms of association;

adopts the work plan and the financial plan for the next calendar year and the work report for the previous calendar year;

adopts the annual financial report;

decides on the change of goals and activities, economic activities, termination of work and distribution of the remaining property of the association;

decides on status changes;

decides on other issues for which the statute does not determine the competence of other bodies of the association.

The association elects one or more natural persons to represent the association.

The authorized person for representation of the association has the following obligations:

is responsible for the legality of the work of the association;

manages the affairs of the association by the decisions of the assembly, unless otherwise provided by the statute;

is responsible for submitting the draft annual financial report to the Assembly;

submits the minutes from the regular session of the Assembly to the competent body of the administration of the district, ie the city of Zagreb, which keeps a register of associations;

concludes agreements and undertakes other legal actions on behalf and for the account of the association;

performs other activities by the law, statute and acts of the association.

In addition to the Assembly, the statute of the association may prescribe and establish other administrative, executive or supervisory bodies.

The supervision over the work of the associations in Croatia is performed by the authorized officials of the competent body of the administration. The competent body of administration in the sense of Article 43 paragraph 1 of the Law on Associations, means the competent administrative bodies in the districts or the city office for general administration in Zagreb, which are competent according to the seat of the association.

This type of supervision refers especially to the obligation of the associations to report on changes in the statute, name, address, selection of authorized persons, ie whether they act on the changes before being registered in the Register of associations, and others.

The state controls as well if the census of the members of the associations is performed in accordance with the requirements.

The compliance with the provisions of the Law on Associations is checked as well. If the association does not comply with them, there is a legal obligation to terminate its activities.

If the official authorized to supervise the work of the association determines that the Law on Associations has been violated, then the body shall issue a Decision ordering the elimination of the identified deficiencies within a certain deadline. Such a decision is submitted to the state administration whose scope of work covers the objectives of the establishment of the association, but also to the state administration body which covers the economic activities of the association (if any).

The Ministry of Finance of the Republic of Croatia supervises the financial operations of the association and the submission of the financial statements. Supervision over the management of funds from public sources is performed by the competent state bodies3031, local and regional self-government units and other public institutions, depending on the specific case in which bodies approve those funds and for what purpose of the association.

Administrative supervision over the implementation of the Law on Associations is performed by the body of the state administration responsible for the affairs of the general administration.

The legislation and all the rules and regulations that refer to the associations established under the Croatian laws, in terms of transparency are based on two principles:

the principle of publicity;

the principle of democratic organization.

The Law on Associations, as a whole, contains provisions regarding the reporting and transparency of associations in Croatia:

The list of members of each association must always be available for inspection by all members and competent bodies, at their request;

The person authorized to represent the association should submit the minutes from the regular session of the Assembly to the competent body of the administration of the district, i.e. the city of Zagreb, which keeps a register of associations;

The Register of Associations and the Register of Foreign Associations are central electronic databases maintained by the competent administrative body for all associations and foreign associations in the Republic of Croatia;

The Register of associations and the Register of foreign associations are public. The data entered in the registers and in the statute of the associations are public and are published on the website of the body of the state administration responsible for the general administration;

The reports on the financial operations of the association with the prescribed documentation are publicly available in the Register of associations through a link to the Register of non-profit organizations;

Associations implementing programs and projects of interest for the common good funded by public sources should inform the donor about their work at least once a year. This information should be published on their website.

The property of the associations registered in the Republic of Croatia consists of:

funds acquired by the association through membership fees;

voluntary contributions and gifts;

money that the association acquires by performing the activities that achieve the goals of the association;

by performing economic activity if it is prescribed by the statute of the association, and in accordance with the special regulations that regulate the conditions for performing this type of activities;

assets acquired through financing programs and projects of the association from the state budget and the budgets of the local and regional self-government units and funds and / or foreign sources;

real estate and other property;

other assets or property rights acquired in accordance with law.

The association can dispose of its property only for the purpose of achieving the goals and performing the activities determined by the statute of the association, in accordance with law.

There are several reasons why an association established in the Republic of Croatia may terminate its existence (Article 48 paragraph 1 of the Law on Associations, op. cit): if the assembly terminates the existence of the association; due to its merge with another association or by division into multiple associations; if the required time for a regular session of the assembly was overdue twice; with a final court decision for termination of the association; by initiating a bankruptcy procedure; at the request of the members, if the number of members of the association has fallen below the number of founders required for the establishment of the association32, and the competent body of the association within one year from the occurrence of this fact has not made a decision to admit new members.

In cases of termination of the association the competent administrative body shall make a decision (as a legal act) for termination of the association and initiation of a liquidation procedure, stating the reasons for that. In addition to the reasons, such a decision should include the name of the liquidator and the manner of conducting the liquidation procedure, as well as information about the name change of the association to which the words "in liquidation" should be added. This fact must be noted in the register of associations.

By initiating a liquidation procedure, the authorizations of the bodies and the persons authorized to represent the association are terminated.

The duties of the liquidator are as follows:

The liquidator is obliged to conduct the liquidation procedure within 60 days from the day of receiving the decision of the competent body of the administration for opening the liquidation procedure;

the liquidator is obliged to determine the balance of the business account of the association;

determine the bookkeeping balance of debts and receivables;

determine other assets of the association through their acquisition from the official records of the Ministry of Finance - Tax Administration, namely to provide confirmation for non-existence of debts for unpaid public duties;

if the liquidator finds that the association has debts, it is obliged to publish an invitation to the creditors to report their claims to the association within 30 days from the day of publishing the invitation, and for all claims it is obliged to invite the debtors to pay their debts within 30 days;

distribute the remaining property in accordance with the law;

After the distribution of the remaining property, the liquidator is obliged to submit the final account and the report on the liquidation to the competent body of the administration within eight days from the day of the completion of the liquidation procedure;

In case the liquidator determines that the funds of the association are not sufficient to settle the obligations of the association, he is obliged to inform the competent court at the headquarters of the association for initiating a bankruptcy procedure.

Based on the received report on the conducted liquidation procedure, the competent administrative body will make a decision (legal act) to delete the association from the register of associations, unless existing debts of the association are determined.

The fundamental decisions within the associations are taken by the General Assembly.

The competencies and responsibilities of the Assembly, as the highest body of the association, are the following:

adopts the statute of the association and its changes;

elects and dismisses persons authorized for representation;

elects and dismisses other bodies of the association, unless otherwise provided by the statute;

decides on the inclusion of the association in unions, communities, networks and other forms of association;

adopts the work plan and the financial plan for the next calendar year and the work report for the previous calendar year;

adopts the annual financial report;

decides on the change of goals and activities, economic activities, termination of work and distribution of the remaining property of the association;

decides on status changes;

decides on other issues for which the statute does not determine the competence of other bodies of the association.

In addition to the purposes – related activities as set by its Statute, the association can, if it is prescribed by the statute, perform economic activities for which it generates income. However, it is not authorized to gain profit of its members or third parties. When the association makes profit from economic activities, it must be used exclusively for the purposes stated in the statute.

According to the provisions of the General Tax Law of the Republic of Croatia, an economic activity is considered an exchange of goods and services on the market with the aim to generate income, profit or other economically significant benefits.

PROFIT TAX

Taxes based on performing economic (entrepreneurial) activities

In the process of determining the performance of economic activities by associations whose non-taxation would lead to gaining an unjustified market advantage, an assessment is made in order to determine whether this activity (or another economically measurable benefit) is performed independently, permanently and for profit. If the association is gaining profit, it is considered similar to the activities of the companies registered for profit.33

The tax period is considered, as a rule, one calendar year.34

If a non-taxation would lead to an unjustified advantage in the market, then the tax administration in the Republic of Croatia will oblige it to pay profit tax.

Separate bookkeeping for economic activity

The Financial Operations and Accounting of Non-Profit Organizations Act35 stipulates the obligation for a non-profit organization to organize accounting (bookkeeping) uniquely for all business events through one general ledger as a single and complete record of all business events.

Tax base

An association that is a taxpayer of profit tax is obliged to pay that tax only for the profit it realizes by performing economic activities. The tax base includes the profit from liquidation, sale, change of legal form and division of the taxpayer, and the tax. The base is determined according to the market value of the property unless otherwise determined by the Law on Profit Taxation.

Expenses that are incurred based on a paid premium of voluntary pension insurance of up to HRK 6,000 (about EUR 800) per year per employee. The amount must be paid by the association to the employees at their voluntary in the voluntary domestic pension fund, up to the amount of HRK 500 (about EUR 66.40) for each month of the tax period.

Tax rate

Income tax is calculated and paid at a rate of 20% on the established tax base.

Income tax advance

The taxpayer pays a tax advance based on the annual tax return for the previous calendar year, that is for the previous tax period. The monthly advance payment of income tax is determined in proportion to the amount of the tax liability according to the annual calculation for the previous year, so the amount of the tax liability for the previous year is divided by the tax period by dividing the amount of the tax liability for the previous tax period by the number of months from the same period.

Annual tax report

The association that is liable to profit tax based on economic activity is obliged to submit an annual tax return to the Tax Administration, with tax calculated, no later than 4 months after the end of the calendar year. That is the period for which the income tax is determined.

Offences and fines

Amount of fines according to the Law on Profit Taxation36:

• a fine of HRK 2,000 (around 265,40 EUR) to HRK 200,000 (around EUR 26.540,00) for the association that is liable to pay profit tax and

• A fine of HRK 2,000 to HRK 20,000 (around EUR 2.654,00 EUR) for the responsible person.

Amount of fines according to the General Tax Law37:

• For minor offences:

o A fine of HRK 2,000 to HRK 200,000 for the association;

o A fine of HRK 2,000 to HRK 20,000 fine for the responsible person.

• For serious tax offences:

o A fine of HRK 5,000 (around EUR 663,50) to HRK 300,000 (around EUR 39.810,00) for the association;

o A fine of HRK 3,000 (around EUR 398,10) to HRK 30,000 (around EUR 3.981,00) for the responsible person.

• The most serious tax offence:

o A fine of HRK 20,000 to HRK 500,000 (around EUR 66.350,00) for the association;

o A fine of HRK 5,000 to HRK 40,000 (around EUR 5.308,00) for the responsible person.

VALUE-ADDED TAX

The taxpayer is an association that independently performs economic activity regardless of the purpose and result of performing that activity. On that basis, the association is obliged to register in the register of VAT payers if the value of deliveries of goods and services made in the previous calendar year was more than HRK 230,000.00. Such an association must be registered in the competent regional unit of the Tax Administration according to the headquarters no later than January 15 of the current year, in order to be registered in the register of taxpayers.

An association whose value of deliveries of goods or services made in the previous calendar year did not exceed HRK 300,000.0038 (small taxpayer) can join the register of VAT payers voluntary.

Non-profit organizations that are liable for VAT are obliged to charge value added tax on all their taxable supplies (on all goods and services) that they sell to customers or provide free of charge.

In Croatia, most delivered goods and services are taxed at a value added tax rate of 25%. The tax liability they pay into the State Budget is determined as the difference between the value added tax charged to customers and the pre-tax that they deducted as input tax from the account of their suppliers (credit method of VAT collection). Namely, organizations liable for VAT have the right to deduct VAT charged by suppliers from incoming invoices for the purchase of products and services used for performing economic activities and thus reduce the payment of tax liability to the State Budget.

Non-profit organizations that are not VAT payers bear this tax as end consumers. They do not charge VAT to their customers, so their deliverables are generally cheaper for the end user. However, these organizations do not have the right to deduct input tax from input invoices for purchased goods, that is purchases, but bear the charged VAT as part of the price of purchased items or services39. Therefore, their deliverables cannot be cheaper by more than 25 % compared to the same organizations that are VAT payers, because their operating expenses are higher due to the VAT contained in the input invoices.

Exemption from VAT

The association does not pay VAT and is not entitled to deduct input tax on:

services and closely related supplies of goods for the benefit of its members for membership fees determined in accordance with the statutes or other rules, provided that such exemption will not distort competition;

membership fees collected from its members in order to fulfil the tasks determined by the statute, when the membership fee is determined according to a certain criterion equally for all members. If the association makes certain deliveries of goods or services for the collected membership fee, then the membership fee is a fee for those deliveries and VAT is calculated and paid on them if the association is in the VAT system. The exemption applies to all associations: the entities paying membership fees in accordance with their statute or the entities operating with donations and voluntary contributions;

donations, voluntary contributions and gifts for the purpose of performing the activities for which the association was founded, grants from the State Budget, budgets of local and regional self-government units, as well as other funds acquired in accordance with the law for performing activities for which the association was established.40

Associations in the Republic of Croatia acquire legal capacity on the day of registration in the Register of Associations of the Republic of Croatia. This register is public, it is kept in electronic form and is unique for all associations in the Republic of Croatia. The registration in the Register of Associations is voluntary and is done at the request of the person authorized to represent the association.

According to the Register of Associations of the Republic of Croatia, at the end of January 2022, the total number of associations in the Republic of Croatia was 52,340. Of this number, 50,634 are active associations, and 1,706 are currently in a stage of liquidation. In 2020 the number of associations in Croatia was 51,679. Therefore, the number of associations is following a generally positive trend.

The associations are not obliged to submit the list of their members to the competent services.

In relation to their members, a single minimum rule has been established for the number of members by the Law of Associations41. So, an association in the Republic of Croatia can not be established if it does not have at least 3 members. The upper limit for membership has not been set. The associations are obliged to store a list of members. This list should always be available for inspection.

The estimated minimum number of members of associations in 2022 is 150 000 people42.

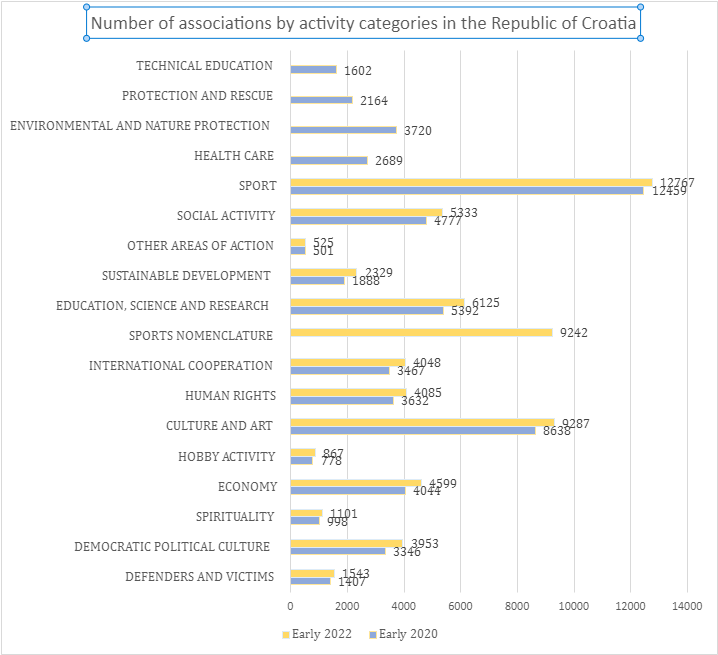

In the Republic of Croatia there are 14 main categories of associations which are divided according to the activities that they perform. Associations in Croatia can register for one or more areas of activity. Thus, an association can have several activities and can be included in more than one category.

The following table is an overview of the associations in the Republic of Croatia, divided by activity categories, at the beginning of 2020, compared to the number from the beginning of 202243.

Figure 1: Number of associations per type of activity

Source: „Infographics on associations in the Republic of Croatia”, https://udruge.gov.hr/UserDocsImages/dokumenti/udruge_u_RH_2020.pdf

According to the study Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 44 11.1% of the associations perform an activity in the field of publishing, and 88.9% of the associations perform an activity in the field of services.

Respondents stated that the economic activity in their association is: project writing and implementation, education, ticket sales, consulting services, facilitation services, moderation services, external evaluation services, sale of publications and other products, bookkeeping services, education and consulting services, book sales, business consulting, promotional services, event organization, advisory and educational services, consulting services, project proposals and business plans.

4.Revenues

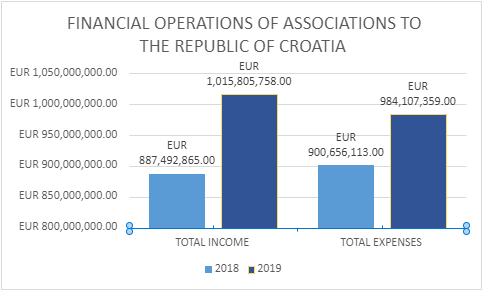

The following table presents the statistical data related to the revenues and expenditures of the associations in the Republic of Croatia for 2018 and 2019.

In 2018, the total revenues of the associations were EUR 887,492,865, while the total expenditures were EUR 900,656,113.

In 2019, associations spent EUR 984,107,359, but earned more than that, i.e. EUR 1,015,805,758.

Figure 2: Financial operations of the associations 2018-2019

According to the study Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 45 the total annual income from performing an economic activity is mostly in the category from HRK 25,000.01 to HRK 50,000.00.

According to the categories, the revenues are as follows:

HRK 0 to HRK 25,000.00 (22.22%);

HRK 25,000.01 to HRK 50,000.00 (47.22%);

HRK 50,000.01 to HRK 100,000.00;

HRK100.000,00 to HRK 200.000,00 (8,33%);

and more than HRK 200,000.01 (19.45%).

From the surveyed associations, the annual incomes from all sources are significantly higher in the higher categories:

HRK 50,000.01 to HRK 100,000.00 (11.11%),

HRK 100,000.01 to HRK 200,000.00 (8.33%),

HRK 50,100.00 to HRK 1,000,000.00 (38.89%)

and more than HRK 1,000,000.01 (27.78%).

Of those surveyed, as many as 77.8% of the associations generate planned revenues from economic activity. The vast majority, 88.9% of the respondents, believe that their economic activity is sustainable, i.e. does not make a loss. The same number of respondents believe that the implementation of economic activity is a form of sustainable entrepreneurship.

In 2019, the economic weight of the associations in Croatia is 1.7% of the GDP.

According to the study Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 46 of the surveyed associations, 11.1% do not have employees, 44.4% have from 1 to 5 employees, and the same number have from 6 to 10 employees. None of the surveyed associations has more than 10 employees.

The main reason for doing business is the following:

no income from non-profit activity (41.67%);

to cover salary expenses (38.89%);

for material costs (2.77%);

for overhead costs (2.77%);

and for withdrawal of funds from EU funds (13.90%).

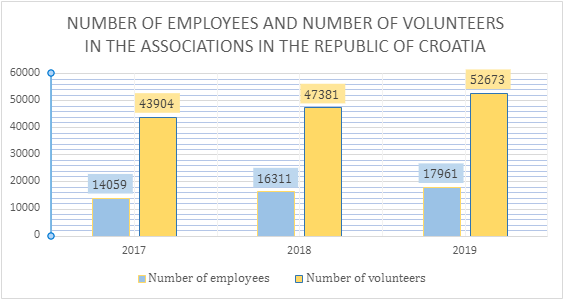

According to the Ministry of Finance, the number of registered volunteers in the Republic of Croatia is growing and the number of hours people spend in volunteer activities is increasing.

Associations play in important role in this process.

Figure 3: Number of emloyees and number of volunteers

7.Cross-border activities

According to the data of the Register of Foreign Associations, a total of 207 foreign associations are currently registered in the Republic of Croatia, of which 149 are active.

References:

Constitution of the Republic of Croatia, "Official Gazette" No. 56/90, 135/97, 113/00, 28/01, 76/10. and 5/14 (https://www.usud.hr/hr/ustav-RH);

Law on Associations, "Official Gazette" No. 74/14, 70/17, 98/19 (https://www.zakon.hr/z/64/Zakon-o-udrugama);

Rulebook on the content and the manner of keeping the register of associations of the Republic of Croatia and the Register of foreign associations in the Republic of Croatia, "Official Gazette" No. 4/15 (https://narodne-novine.nn.hr/clanci/sluzbeni/2015_01_4_76.html);

Law on Foundations, "Official Gazette" No. 36/95, 64/01 (https://www.zakon.hr/z/164/Zakon-o-zakladama-i-fundacijama);

Law on Institutions, "Official Gazette" No. 76/93, 29/97, 47/99, 35/08, 127/19 (https://zakon.hr/z/313/Zakon-o-ustanovama);

Law on Volunteering, "Official Gazette" No. 58/07, 22/13, 84/21 (https://zakon.hr/z/258/Zakon-o-volonterstvu);

Law on Financial Operations and Accounting of Non-Profit Organizations, "Official Gazette" No. 121/14 (https://narodne-novine.nn.hr/clanci/sluzbeni/2014_10_121_2300.html);

General Tax Law of the Republic of Croatia "Official Gazette" No. 115/16, 106/18, 121/19, 32/20, 42/20 (https://zakon.hr/z/100/Op%C4%87i-porezni-zakon);

Law on Profit Tax "Official Gazette" No. 177/04, 90/05, 57/06, 146/08, 80/10, 22/12, 148/13, 143/14, 50/16, 115/16, 106/18, 121/19, 32/20, 138/20 (https://zakon.hr/z/99/Zakon-o-porezu-na-dobit);

Decree on criteria, measures and procedures of financing and contracting of programs and projects of interest for common goods implemented by associations, "Official Gazette" No. 25/15 (https://narodne-novine.nn.hr/clanci/sluzbeni/2015_03_26_546.html);

Decree for performing professional activities within the Government of the Republic of Croatia, the Office for Associations, "Official Gazette" No. 34/12 (https://narodne-novine.nn.hr/clanci/sluzbeni/2012_03_34_820.html);

Register of associations of the Republic of Croatia (https://registri.uprava.hr/#!udruge);

Register of foreign associations (https://registri.uprava.hr/#!strane-udruge);

Office of Associations of the Republic of Croatia, Infographics - Associations in the Republic of Croatia, Zagreb 2020 (https://udruge.gov.hr/UserDocsImages/dokumenti/udruge_u_RH_2020.pdf);

Office for Associations and the National Foundation for the Development of Civil Society, Guide for the Establishment of an Association, Zagreb 2015 (https://udruge.gov.hr/UserDocsImages/dokumenti/Vodi%C4%8D%20za%20osnivanje%20udruge%20i%20uskla%C4%91ivanje%20s%20novim%20propisima%20-%20New.pdf);

Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 (https://hrcak.srce.hr/file/323020);

Kivač Karlo, Poslovanje neprofitnih organizacija, Undergraduate thesis, University North, 2019, (https://repozitorij.unin.hr/islandora/object/unin%3A2957/datastream/PDF/view);

Ministry of Finance of the Republic of Croatia Tax Administration, TAX HANDBOOK FOR ASSOCIATIONS, Zagreb 2015 (https://www.porezna-uprava.hr/HR_publikacije/Prirucnici_brosure/PP%20Udruge%20KB%202012%20WEB.pdf);

CLASSIFICATION OF ASSOCIATION ACTIVITIES, "Official Gazette" No. 4/15;

Eva Varga, Social Enterprise Ecosystems in Croatia and the Western Balkans, 2017;

Office of Associations of the Republic of Croatia, Annual Work Plan of the Office of Associations of the Republic of Croatia, Zagreb 2021;

State Statistical Office of the Republic of Croatia, Statistical Information for 2021, Zagreb 2021;

https://narodne-novine.nn.hr/clanci/sluzbeni/dodatni/434416.pdf

https://www.hnb.hr/temeljne-funkcije/monetarna-politika/tecajna-lista/tecajna-lista

https://udruge.gov.hr/arhiva/izdvojeno-hrv/u-fokusu/registar-neprofitnih-organizacija/971

https://profitiraj.hr/zbog-ovih-6-razloga-gradani-radije-otvaraju-udruge-umjesto-tvrtki/

https://udruge.gov.hr/financiranje-programa-i-projekata-udruga-iz-javnih-izvora/2772

https://mfin.gov.hr/istaknute-teme/neprofitne-organizacije/106

https://www.cerno-zagreb.hr/registar-neprofitnih-organizacija-0

http://udruga-opcina.hr/poslovne-udruge/neprofitne-organizacije-i-povezivanje-subjekata/

https://abc-solutions.hr/gospodarska-djelatnost-udruga-ostalih-neprofitnih-organizacija/

http://udruga-opcina.hr/poslovne-udruge/neprofitne-organizacije-i-povezivanje-subjekata/

https://www.moj-planer.hr/blog/knjigovodstvo/udruge-i-gospodarska-djelatnost

According to Article 4 of the Law on Associations, "Official Gazette" No. 74/14, 70/17, 98/19 (https://www.zakon.hr/z/64/Zakon-o-udrugama)↩︎

"Official Gazette" No. 56/90, 135/97, 113/00, 28/01, 76/10. and 5/14 (https://www.usud.hr/hr/ustav-RH)↩︎

Lex specialis, in legal theory and practice, is a doctrine relating to the interpretation of laws and can apply in both domestic and international law contexts. The doctrine states that if two laws govern the same factual situation, a law governing a specific subject matter overrides a law governing only general matters. (https://en.wikipedia.org/wiki/Lex_specialis)↩︎

"Official Gazette" No. 74/14, 70/17, 98/19 (https://www.zakon.hr/z/64/Zakon-o-udrugama)↩︎

Based on the number of associations and the minimum requirements about the number of members necessary to establish an association.↩︎

"Official Gazette" No. 56/90, 135/97, 113/00, 28/01, 76/10. and 5/14 (https://www.usud.hr/hr/ustav-RH)↩︎

The Constitution of the Republic of Croatia is a unique general legal act with the highest legal force in the Republic of Croatia, which contains a predominant number of constitutional norms. It was passed by the Croatian Parliament on December 22, 1990, so it is called the Christmas Constitution. It contains 152 articles in 10 parts and therefore belongs to shorter constitutions according to the length of the text. (https://hr.wikipedia.org/wiki/Ustav_Republike_Hrvatske)↩︎

According to Article 4 of the Law on Associations, "Official Gazette" No. 74/14, 70/17, 98/19 (https://www.zakon.hr/z/64/Zakon-o-udrugama)↩︎

Lex specialis, in legal theory and practice, is a doctrine relating to the interpretation of laws and can apply in both domestic and international law contexts. The doctrine states that if two laws govern the same factual situation, a law governing a specific subject matter overrides a law governing only general matters. (https://en.wikipedia.org/wiki/Lex_specialis)↩︎

"Official Gazette" No. 74/14, 70/17, 98/19 (https://www.zakon.hr/z/64/Zakon-o-udrugama)↩︎

"Official Gazette" No. 4/15 (https://narodne-novine.nn.hr/clanci/sluzbeni/2015_01_4_76.html)↩︎

"Official Gazette" No. 36/95, 64/01 (https://www.zakon.hr/z/164/Zakon-o-zakladama-i-fundacijama)↩︎

"Official Gazette" No. 76/93, 29/97, 47/99, 35/08, 127/19 (https://zakon.hr/z/313/Zakon-o-ustanovama)↩︎

"Official Gazette" No. 58/07, 22/13, 84/21 (https://zakon.hr/z/258/Zakon-o-volonterstvu)↩︎

"Official Gazette" No. 121/14 (https://narodne-novine.nn.hr/clanci/sluzbeni/2014_10_121_2300.html)↩︎

"Official Gazette" No. 4/15 (https://narodne-novine.nn.hr/clanci/sluzbeni/2015_03_26_546.html)↩︎

from Article 11 to Article 21↩︎

"Official Gazette" No. 34/12 (https://narodne-novine.nn.hr/clanci/sluzbeni/2012_03_34_820.html)↩︎

The Register of associations of the Republic of Croatia is public and can be accessed at the following link: https://registri.uprava.hr/#!udruge↩︎

The Register of foreign associations can be accessed at the following link: https://registri.uprava.hr/#!strane-udruge↩︎

The ratio of the Croatian kuna to the euro can be seen on the website of the National Bank of the Republic of Croatia at this link: https://www.hnb.hr/temeljne-funkcije/monetarna-politika/tecajna-lista/tecajna-lista↩︎

Article 36 paragraph 1 of the Law on Associations, op. cit.↩︎

Article 32 paragraph 2 of the Law on Associations, op. cit.↩︎

Decree on criteria, measures and procedures of financing and contracting of programs and projects of interest for common goods implemented by associations, "Official Gazette" No. 25/15 (https://narodne-novine.nn.hr/clanci/sluzbeni/2015_03_26_546.html)↩︎

Personal Identification Number (OIB), is a permanent identification mark of Croatian citizens and legal entities with a registered office in the Republic of Croatia which is used as a unique identifier in various official records. OIB is also awarded to foreign natural and legal persons for whom there is a reason for monitoring in the territory of the Republic of Croatia. The personal identification number is unique, non-indicative, unchangeable and unrepeatable. (https://hr.wikipedia.org/wiki/Osobni_identifikacijski_broj)↩︎

The association can by statute define different categories of membership (including minors and persons deprived of legal capacity), where only one or some categories can include full members, there may be honorary members and similar categories. It is very important that these categories and the manner of acquiring the status in them are well and precisely described in the statute.↩︎

For example, the list of members may contain the category of membership if it is determined by the statute, the status of the member, the amount and the date of payment of the membership fee if it is determined by the statute, etc.↩︎

"Official Gazette" No. 115/16, 106/18, 121/19, 32/20, 42/20 (https://zakon.hr/z/100/Op%C4%87i-porezni-zakon)↩︎

"Official Gazette" No. 177/04, 90/05, 57/06, 146/08, 80/10, 22/12, 148/13, 143/14, 50/16, 115/16, 106/18, 121/19, 32/20, 138/20 (https://zakon.hr/z/99/Zakon-o-porezu-na-dobit)↩︎

Article 46 paragraph 2 of the Law on Associations, op. cit.↩︎

In accordance with Article 34 of the Decree on criteria, measures and procedures of financing and contracting of programs and projects of interest for common goods implemented by associations cited above, the provider of financial resources in cooperation with the beneficiary monitors the implementation of funded programs or projects of associations .

On the other hand, according to Article 1 of the same Decree, it can be understood that the provider of financial resources for financing an association from public sources can be different bodies, local units, legal entities owned by the state ...

Therefore, the legislator here operates with the term "competent body" because all these associations that use funds from public sources, in some way "report" to a different competent body.

On the other hand, for those associations that are funded by European Union funds, there is also a special approach: https://udruge.gov.hr/istaknute-teme/programi-eu-za-razvoj-civilnog-drustva/upravljanje-nepravilnostima-3160/3160↩︎

Under Article 11 paragraph 1 of the Law on Associations of the Republic of Croatia, an association can be constituted by at least three founders.↩︎

Law on Profit Tax "Official Gazette" No.177/04, 90/05, 57/06, 146/08, 80/10, 22/12, 148/13, 143/14, 50/16, 115/16, 106/18, 121/19, 32/20, 138/20 (https://zakon.hr/z/99/Zakon-o-porezu-na-dobit)↩︎

As an exception, the tax administration may, at the request of the taxpayer, approve the tax period and the calendar year to vary, with the tax period not exceeding 12 months. The taxpayer can not change the selected tax period for 3 years.↩︎

Law on Financial Operations and Accounting of Non-Profit Organizations, "Official Gazette" No. 121/14 (https://narodne-novine.nn.hr/clanci/sluzbeni/2014_10_121_2300.html)↩︎

Article 38, Law on Profit Tax "Official Gazette" No. 177/04, 90/05, 57/06, 146/08, 80/10, 22/12, 148/13, 143/14, 50/16, 115/16, 106/18, 121/19, 32/20, 138/20 (https://zakon.hr/z/99/Zakon-o-porezu-na-dobit)↩︎

Article 192, Article 193 and Article 194 of the General Tax Law of the Republic of Croatia "Official Gazette" No. 115/16, 106/18, 121/19, 32/20, 42/20 (https://zakon.hr/z/100/Op%C4%87i-porezni-zakon)↩︎

From 1 January 2018, the threshold for entry in the VAT register has been increased to 300.000,00 kunas instead of the 230.000,00 kunas, as it was before.↩︎

Eg. as part of the price of office supplies, purchased fixed assets, etc.↩︎

When these funds are given for counter-delivery, then it is not a donation, but a fee for the delivery of goods or services.↩︎

Article 11, paragraph 1 of the Law on Associations, op. cit.↩︎

Based on the number of associations and the minimum requirements about the number of members necessary to establish an association.↩︎

The data for 2020 are extracted from the document „Infographics on associations in the Republic of Croatia” which document can be found here https://udruge.gov.hr/UserDocsImages/dokumenti/udruge_u_RH_2020.pdf, while the data for early 2022 are from the Register of Associations which can be found here https://registri.uprava.hr/#!udruge↩︎

Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 (https://hrcak.srce.hr/file/323020)↩︎

Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 (https://hrcak.srce.hr/file/323020)↩︎

Simunkovic Antonija, Simunkovic Mario, ECONOMIC ACTIVITY WITH NON - PROFIT ORGANIZATIONS TO THE REPUBLIC OF CROATIA, Zagreb 2019 (https://hrcak.srce.hr/file/323020)↩︎