Comparative legal analysis of associations laws and regimes in the EU. Country Report: Ireland

Executive summary

Many legal forms of non-profit organizations (charities) exist in Ireland: unincorporated associations, incorporated or unincorporated trusts, designated limited companies, corporations limited by guarantee, friendly societies, industrial and provident societies, designated activity companies (DAC) (since 2014), organizations incorporated by Royal Charter or Act of Parliament.

According to the Charities Act 2009, a charity can be established only for a charitable purpose, and its activities must advance that purpose. Pursuant to Section 2(1) of the Charities Act, a charity cannot engage in certain commercial or political activities. In addition, a division between mutual benefit and public benefit organizations applies.

Charity law in Ireland is governed by a mixture of legislation, case law, and regulations.

A primary source of law in Ireland is the Constitution. It guarantees the right to form associations and unions (Article 40.6.1.iii). The Charities Act 2009 is essential in the field.

The unincorporated association does not have legal personality. As a consequence it cannot enter into legal relations. Members are jointly and severally liable for the association’s debts. Similar to an unincorporated association, a trust ordinarily has no legal personality; the trustees themselves must enter into legal relations and accept personal liability. A company limited by guarantee (CLG) is an alternative type of corporation. It is used primarily for non-profit organizations that require legal personality. It does not have shared capital; its members commit to contribute a nominal amount (€1 in most cases) toward the liquidation of the company.

The people who rule the charities are the Charity trustees: in an unincorporated association they may be known as committee members; If the trustees of a specific trust are the ones who decide policy and control the assets, then they are also charity trustees; If the charity is incorporated as a company, these people may also be known as directors or board members.

Charities must register before the the Charities Regulator, which does not currently charge a fee for registration. However a fee of EUR100 is envisaged.

The Irish tax law allows a charity to conduct certain economic activities, or "trading," with profits exempt from tax under a “trading exemption.”

The tax regime in Ireland with relevance to the activities of the charities includes several types of tax reductions affecting: income tax, corporation tax (in the case of companies), capital gains tax, Deposit Interest Retention Tax (DIRT), capital acquisitions tax, stamp duty, and dividend withholding tax.

The charitable entities are not exempt from VAT. Despite this, many items that relate to charitable activities are exempt. To qualify as a charitable organization, the purpose of the organization must appear on the list of purposes in Section 3 of the Charities Act and must also be of public benefit (Charities Act 2009 Section 3(2)).

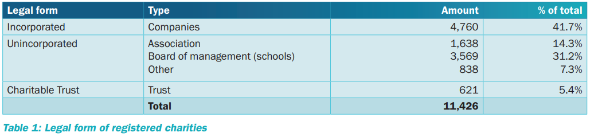

The total number of charities in Ireland in 2020 is 11,426. Of them 1638 are unincorporated associations, 4760 are incorporated companies, 621 are charitable trusts. There were 74,124 charity trustees on the Register of Charities on 31 December 2020, an increase of 10% from 20191.

The total turnover of the charity sector in 2021 is EUR 13.9bn and its economic weight is 3% of the GDP.

1.Definition, types of associations 5

3. Formation requirements and constitutive acts and elements 8

4. Registration requirements 10

8. Definitions of public interest 12

10. Economic activities permitted 16

11. Governance, operating rules and bodies 17

13. Reporting and transparency 19

14. Resources and assets management 20

6. Share between voluntary and paid work 25

LEGISLATIVE FRAMEWORK

Many forms of non-profit organizations exist in Ireland: unincorporated associations, incorporated or unincorporated trusts, companies, corporation limited by guarantee, friendly societies, industrial and provident societies, designated activity companies (DAC) (since 2014), organizations incorporated by Royal Charter or Act of Parliament .

According to the Charities Act 2009, a charity can be established only for a charitable purpose, and its activities must advance that purpose. Pursuant to Section 2(1) of the Charities Act, a charity cannot engage in certain commercial or political activities. In addition, a division between mutual benefit and public benefit organizations applies.

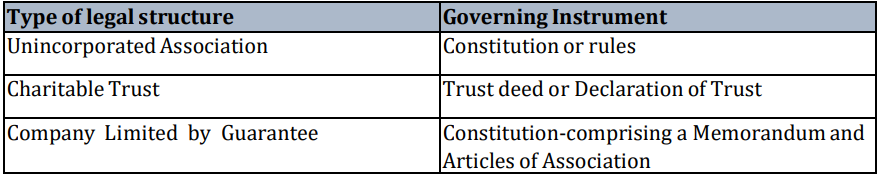

The majority of public benefit organizations are established as one of the following legal forms: An unincorporated association; a trust; or a company limited by guarantee (CLG) and industrial and provident societies or friendly societies.

What is more, the Companies Act 2014 introduced another legal form: the Designated Activity Company (DAC). Entities registered in one of these forms can qualify for charitable tax exemption.

The Charities Act 2009 sets out the requirements which organisations must meet if they are to be considered a charitable organisation and therefore regulated by the Act.

The Charities Regulator describes this as ‘the charity test’ and, to qualify, an organisation must meet all of the following criteria:

operates in the Republic of Ireland (this does not mean that the people from the organisation will benefit need to be in Ireland);

exists for a charitable purpose(s);

promotes this charitable purpose(s) only;

carries out all activities to further this charitable purpose(s);

exists to benefit the public or a section of the public in Ireland, or elsewhere, through its charitable purpose(s);

is not an excluded body.

The Charities Act 2009 sets out specific types of organisations which are not, and cannot become, charities. These are known as excluded bodies and these are political parties or bodies that promote political parties or political cause, sporting bodies, a trade unions or a representative bodies of employers, a chambers of commerce and a bodies that promotes purposes that are unlawful.

The following legal forms may be registered as charities:

Unincorporated association

An unincorporated association is a membership-based organization, which is created by the oral or written agreement of its members. The governing bodies of the association, usually defined by the statute of the association are interpreted according to contract law. The association does not have legal personality. As a consequence, its members are jointly and severally liable for the association’s debts.

Unincorporated associations are considered a common form as the requirements for their formation are not difficult for the founders.

Trust

This is the organization in which one or more persons hold funds or property on behalf of other persons. They operate under the authority of a “deed of trust”.

A trust has no legal personality; the trustees must enter into legal relations and accept personal liability. Under certain conditions (as per Section 2 of the Charities Act 2009), a trust may become a body corporate. The trustees apply to the Charities Regulatory Authority (CRA) to obtain this status.

Corporations limited by guarantee

An alternative type of corporation, used primarily for non-profit organizations is a company limited by guarantee (CLG). The CLG does not have share capital; its members are guarantors, not shareholders. The guarantors contribute a nominal amount (for instance €1) toward winding up the company, should this becomes necessary. A CLG is not allowed to distribute profits to its members, and it is eligible to apply for charitable tax exemption. The governing instruments of a CLG are the memorandum and the articles of association.

Designated Activity Company

Тhe Designated Activity Company (DAC) is a legal form which exists since 2014 according to the Companies Act 2014.. Unlike a CLG, a DAC is a company with share capital that can be limited by guarantee. This limited company type is applicable to those companies who wish to outline and define a specific type of business in their Constitution, rather than have unlimited powers as per the LTD company type. DAC ‘s retain Memorandum & Articles of Association as part of an overall Constitution document.

In the following sections of the report, all the characteristics of the types of associations mentioned above will be explained in more detail. However, the law to which they are subject is primarily the Charities Act 2009, which applies to all the mentioned types of associations that acquire the status of charitable organizations. So, unincorporated associations, trusts, CLGs and DACs are regulated under the Charities Act 2009. But, CLGs and DACs unlike unincorporated associations and trusts have legal subjectivity. So, they are primarily subject to the provisions of the Companies Act 2014, and in terms of acquisition with the status of a charitable organization, the manner of registration, submission of reports, etc. they are subject to the provisions of the Charities Act 2009.

Most organisations begin their activities as an unincorporated association of individuals. However, as they grow and their activities become more complex, the organisations often decide to incorporate as a company limited by guarantee. The incorporation limits the personal liability of members of the board or committee.

Charity law in Ireland is governed by a mixture of legislation, case law, and regulations.

A primary source of law in Ireland is the Constitution. It guarantees the right to form associations and unions (Article 40.6.1.iii). Any type of association for whatever purpose can be formed, whether it is sporting, social, charitable, commercial or political.

This right is limited by legislation to protect public order and morality. For example, associations formed for the purpose of treason or some anti-constitutional or illegal purpose cannot rely on this right to freedom of association.

Similarly, no one can be forced to join any particular association or union. At the same time, a union or association cannot be forced to accept any member.2

The Charities Act 2009 is essential in the field. The Act covers several important issues: the definition of charity; the meaning of public benefit; the determination of tax liability.3

The definition of a charitable organization is as follows:

The Charities Act 2009 defines a charitable organisation as the trustees of a charitable trust or a body corporate (this usually means a company) or an unincorporated body:

that promotes a charitable purpose only;

that is required under its Constitution or governing documents to apply all of its property to further that purpose except for money used in its operation and maintenance (for example, staff wages) and, in the case of religious organisations or communities, money used for the accommodation and care of the members of the organisation or community, and;

none of whose property is payable to the members of that body except in specific circumstances.

The Charities Act 2009 sets out specific types of organisations which are not, and cannot become, charities. These are known as excluded bodies4.

Additional legislative acts that must be considered are:

Companies Act (last amended in 2019) [2];

Friendly Societies Act 1875; Friendly Societies Act 1896 (as amended); Friendly Societies (Amendment) Act 1953; Friendly Societies (Amendment) Act 1977;

The Taxes Consolidation Act 1997 (as amended 2021);

Finance Act 2010 (as last amended in 2022);

VAT Act 1972 (as amended in 2021).

Unincorporated association

The unincorporated association is based on membership of participants under the form of an agreement. In the past, this agreement was concluded orally. Now, the written forms are common. The agreement contains the terms and conditions that are written in the association’s constitution. As it has no legal personality, it cannot enter in various commercial relations on its own. Also, associations fall under the Irish Contract Law. The members of the association are liable for the structure’s debts and obligations with their personal assets.

Trust

The formation requirements for trusts include drafting a deed of trust where the settlor, the trustee (s) and beneficiary (ies) are appointed. If the trust is created as a non-profit organization, the settlor will appoint a trustee to administer the assets, which are left to the beneficiaries.

Similar to the associations, the trust does not have a legal personality. The services provided by the trustee relies on a contract under which he or she accepts personal liability during the administration of the assets.

Corporations limited by guarantee

A Company Limited by Guarantee in Ireland is the one which does not have a share capital and the constitution of which provides that the liability of its members is limited to the amount that the members may, in the constitution, respectively undertake to contribute to the assets of the CLG in the event of winding up.

The procedure to set up a Company Limited by Guarantee in Ireland is as follows:

The first step is similar to any other company formation in Ireland, i.e. registering the company name. The name of a CLG must end with the words “company limited by guarantee”, or “cuideachta faoi theorainn ráthaíochta”. The words “company limited by guarantee” may be abbreviated to “c.l.g.” or “clg”, and the words “cuideachta faoi theorainn ráthaíochta” may be abbreviated to “c.t.r.” or “ctr”, in any usage after a company’s registration;

The company must have a registered office in Ireland. The registered office of a company is the address to which CRO correspondence and all formal legal notices addressed to the company will be sent;

The next step is to draft the constitution (Memorandum and Articles of Association). The constitution must accord with the form set out in the Act and comprise of a memorandum of association and articles of association;

After this, the next step is to pay the registration fees.

The Charitable organisations mainly take one of three types of legal structure, each of which typically has its own constitution or governing instrument:

The governing instrument or the Constitution must contain the following elements:

the name of the charity;

the main objects of the charity which must fall under one of the primary charitable purposes of the Charities Act 2009;

the powers of the charity (which allow the charity to carry out its function, e.g. the power to fund-raise or hold property);

details of its geographic range of operation;

its rules, which should cover membership, appointments and dismissals, executive committees, meetings and any other rules required for the proper conduct of the organisation;

the specific income and property clauses that must be contained in the Constitution, regardless of the legal form.

The Charities Regulator has produced a set of Model Constitutions5. which serve organizations to more easily define the guidelines in their documents, while maintaining the most important elements that they must contain.

The Charities Regulatory Authority (Charities Regulator) is the statutory body responsible for regulating charitable organisations in Ireland. It maintains a public register of charities and monitors their compliance with the Charities Act 2009, which sets out a charity's legal obligations for operating in Ireland.

A charitable organisation that intends to operate or carry on activities in the State shall, in accordance to the Authority must be registered in the register, and it shall be the duty of the charity trustees of the charitable organisation concerned to make the application on behalf of the charitable organisation.

The Charities Regulator’s other functions include:

increasing public trust in how charities are run;

encouraging trustees to comply with their duties;

holding charities accountable to their donors, beneficiaries and the public;

investigating charities in agreement with the Charities Act 2009;

encouraging better management of charities by providing information and advice, including guidelines, codes of conduct and template constitutional documents.

The Charities Regulator maintains a register of charities that are active in Ireland6. It is an offence for a charitable organisation to carry out activities if it is not registered with the Charities Regulator.

Organisations that want to carry out charitable activities must register with the Regulator. They must provide information about their organisation including where it operates, what it does and who the trustees are. They must also provide information about the organisation’s income and fundraising activities, including:

bank account details;

how they fundraise;

details of any property they are using;

a business plan, including:

a short history of the organisation;

a description of who will donate and who will benefit;

a summary of the operational plan;

detailed financial projections;

a summary of the risks they have identified.

Each organisation must provide a copy of its Constitution or governing documents. Organisations who work with vulnerable people and children must also give details of the risk assessment procedures and safety checks.

If the Charities Regulator approves an organisation’s application, it awards them charitable status, assigns them a Registered Charity Number and lists them as a charity on the public register. The public register lists the charity’s:

name;

addresses;

trustees’ names;

objectives (why the charity has been set up and what it hopes to achieve);

registration number;

financial records, including gross income and total expenditure.

As mentioned earlier, unincorporated associations and trusts do not have legal personality. They gain the status of charitable organization by registering in the Charities Regulatory Authority.

But, unlike them, the Corporations limited by guarantee (CLGs) have legal personality. Before registration in the Charities Regulatory Authority, they should be registered with the Companies Registration Office (CRO).

The Charities Regulator does not currently charge a fee for registration. However a fee of €100 is envisaged.

Unincorporated associations

Members of an unincorporated associations can have personal liability without fault for acts by other members. That liability is personal liability on the part of each of the members of that unincorporated association at the time that the act itself was carried out. New members joining after the event do not ‘inherit’ that liability7.

However, since the Irish legal system also recognizes and values common law, it is important to make one important point here. In 2017, the Irish Supreme Court delivered a judgment in the case of Hickey v McGowan which clarified the law of tortious liability for members of unincorporated associations. The Supreme Court emphasised that such liability is personal to individual members as opposed to the unincorporated association itself. 8

Trust

Charity trustees are responsible for the affairs of the charity and must carry out their duties diligently. In a situation when they fail to do it, this could be considered a breach of trust. The trustees could be held personally liable for any loss or damage that their charity sustains as a result of their actions9.

Company Limited by Guarantee (CLG)

The constitution of a Company Limited by Guarantee provides that the liability of its members is limited to the amount that the members contribution to the assets of the CLG in the event of a liquidation10.

7. Legal personality

The unincorporated association does not have legal personality. As a consequence it cannot enter into legal relations. Members are jointly and severally liable for the association’s debts. An unincorporated association is a group that does not have separate legal personality from its members. It is not possible to contract with an unincorporated association itself. Individuals contracting on behalf of an unincorporated association may be personally liable for breaches of the relevant contract or they may be found to be acting as agents for the members, depending on the scenario.

Similar to an unincorporated association, a trust ordinarily has no legal personality; the trustees themselves must therefore enter into legal relations and accept personal liability. As a matter of convenience, trusts are often named by practitioners as parties to an agreement. However, a trust, as a ‘non-entity’, does not have legal capacity to contract in its own right. As a trust is not a legal entity, it cannot issue or accept legal proceedings. The trustee is the party with standing to sue and defend for and on behalf of the trust. A claim based on a contract entered into by a trustee in its representative capacity may be asserted against the trust only by proceeding against the trustee. Where actions are taken by or against the trust, courts may be amenable to amending the proceedings to refer to the trustee unless this would cause hardship to the other party.

A company limited by guarantee (CLG) is an alternative type of corporation. It is used primarily for non-profit organizations that require legal personality. It does not have shared capital; its members commit to contribute a nominal amount (€1 in most cases) toward the liquidation of the company. A company may be registered as a CLG by the re-registration or registration as a CLG of a body corporate under the Companies Law, by the merger of 2 or more companies or by the division of a company.

There is no requirement for non-profit organization to be established for public benefit (many of them are registered for a mutual benefit, or the benefit of their members). However, if formed for a purpose that serves the public benefit, they are eligible for charitable status.

For an organization to be eligible for registration as a charitable organization in the Republic of Ireland, it must consequently meet the following three conditions:

to operate in the Republic of Ireland;

to have exclusively charitable purposes;

to provide a clear public benefit, in this country or elsewhere.

A public benefit is something which is beneficial in an identifiable way to the general public, or a section of the public. For example, fundraising to cover the medical bills for one individual does not provide a public benefit, as it benefits only one individual. However, fundraising for the purpose of paying the medical bills of a class of persons who have the same or similar illness would meet the criteria of providing a benefit to the public, even though within that class some individuals are selected to benefit.

The Charities Act 2009 defines “charitable purpose” as follows:

the prevention or relief of poverty or economic hardship;

the advancement of education;

the advancement of religion; and

any other purpose that is of benefit to the community.11 The final category, “any other purpose that is of benefit to the community,” includes:

the advancement of community welfare, including the relief of those in need by reason of youth, age, ill-health, or disability;

the advancement of community development, including rural or urban regeneration; The promotion of civic responsibility or voluntary work;

the promotion of health, including the prevention or relief of sickness, disease, or human suffering;

the advancement of conflict resolution or reconciliation;

the promotion of religious or racial harmony and harmonious community relations; The protection of the natural environment;

the advancement of environmental sustainability;

the advancement of the efficient and effective use of the property of charitable organizations;

the prevention or relief of suffering of animals;

the advancement of the arts, culture, heritage, or sciences; and

the integration of those who are disadvantaged, and the promotion of their full participation in society 12.

Charity trustees are the people who control and are legally responsible for the management of a charity. Charity trustees include:

Trustees listed in the deed of trust of a charitable trust, if they are the ones who decide policy and control the assets

The directors and other officers of a company where the charity is a company. They will have additional duties under company law and common law in their capacity as a company director.

Officers, or anyone acting officially in control of the organisation such as committee members, in cases where the organisation is an unincorporated group

You cannot profit from your duties as a charity trustee. You cannot accept a salary or receive other benefits specifically for acting as a charity trustee. However, your charity can reimburse you for any reasonable expenses that arise from undertaking your duties as a trustee.

Duties of a trustee

The duties as a charity trustee are set out in the governing document of your charity, legislation and common law (the body of Irish law based on established practice and decisions of the courts). There are specific duties under the Charities Act 2009 and are also required to ensure that the charity complies with other relevant legislation.

The general duties as a trustee are to:

Comply with the charity’s governing document

Ensure that the charity is carrying out its charitable purposes for the public benefit

Act in the best interests of the charity

Manage the assets of the charity

Make appropriate investment decisions

Ensure that the charity is registered on the Charities Regulator’s Register of Charities

Ensure that the charity keeps proper books of account (these must include daily entries of all money your charity receives and pays out, as well as a record of your charity’s assets and liabilities)

Ensure that the charity prepares and gives its financial accounts to the Charities Regulator

Ensure that the charity prepares and gives its annual report to the Charities Regulator

Ensure that the charity comply with any directions issued by the Charities Regulator

Ensure that the charity inform the Charities Regulator if you think that a theft or fraud has taken place at the charity

Trustees must also ensure that their charity complies with the requirements of other relevant legal acts, for example, data protection, health and safety and employment legislation.

Exclusion criteria for trustees exists as well. The following categories of citizens can not be trustees, if they:

Are bankrupt;

Enter into an insolvency arrangement under the Personal Insolvency Act 2012;

Are convicted of an offence;

Are sentenced to a term of imprisonment;

Are disqualified from acting as a director or auditor or from managing a company under the Companies Acts 2014 as amended;

Are disqualified from being a pension fund trustee under the Pensions Acts;

Have been removed from the position of a charity trustee by a High Court order under the Charities Act 2009.

If the trustee is a legal entity such as a company, they cannot be a trustee if the company is being wound up.

If you cannot be a trustee because you fall into one of the categories above, you can apply to the High Court and ask to be allowed to work as a trustee of a particular charity or a particular class of charities. The High Court can make an order that allows you to be a trustee if it considers that this would be in the public interest and best interests of the charity concerned.

It is an offence to act as a trustee if you fall into one of the categories above and have not received an order from the High Court that allows you to work as a trustee.

Unincorporated association

An unincorporated association is a membership-based organization, created by the oral or written agreement of its members.

Trusts

A beneficiary of trust is the individual or group of individuals for whom a trust is created. The trust creator or grantor designates beneficiaries and a trustee, who has a fiduciary duty to manage trust assets in the best interests of beneficiaries as outlined in the trust agreement.

Company Limited by Guarantee (“CLG”)

Unless its constitution provides otherwise, a CLG can avail of powers in the Act to pass unanimous resolutions of members instead of holding physical meetings. A CLG with two or more members may not dispense with the requirement to hold an Annual General Meeting. A CLG cannot use the majority members written resolution and can, in its constitution, remove the right of members to appoint proxies.

The Irish tax law allows a charity to conduct certain economic activities, or "trading," with profits exempt from tax under a “trading exemption.”

The Revenue Commissioners13 defines trading as “generally involving the sale of goods or services to customers with a view to generating profit.” In order to qualify for a trading exemption, a body established only for charitable purposes must apply the income derived from its trading solely to advancing those purposes.

In addition, the organization ordinarily must satisfy one of the following two conditions:

The trade must occur in the course of carrying out a primary purpose of the charity (Taxes Consolidation Act 1997 Section 208(2)(b)(i)). Examples include the following:

an art gallery or museum holding an exhibition and charging an admission fee;

a school providing an educational service for a fee;

a theatre selling tickets to its productions; and

a hospital providing health care services for a fee.

Economic activities that would not otherwise qualify may nonetheless fall under the trading exemption if they are ancillary to pursuing the charity's primary purpose. Examples include a theatre selling food and drink to its patrons, or a hospital selling papers, flowers, and toiletries to patients and visitors. The Revenue Commissioners decides on a case-by-case basis.

The work in connection with the trade must be carried on mainly by beneficiaries of the charity (Taxes Consolidation Act 1997 Section 208(2)(b)(ii)).

Many charities engage in activities where the charity's beneficiaries carry out work. The work usually has an educational or remedial purpose and thus often falls under the first category. However, even if the work does not advance the charity's primary purpose, it can still qualify for tax exemption. In order to obtain this form of exemption, the organization must prove that the greater part of its trade is undertaken by the beneficiaries, particularly where non-beneficiaries (such as employees or volunteers) also participate. With regard to commercial activities generally, a charity must apply to the Revenue Commissioners for specific exemption, and each application is considered on a case-by-case basis.

However, the economic activities of the other non-profit organizations which are non-charitable are not restricted.

The people who rule the charities are the Charity trustees.

In an unincorporated association they may be known as committee members;

If the trustees of a specific trust are the ones who decide policy and control the assets, then they are also charity trustees;

If the charity is incorporated as a company, these people may also be known as directors or board members.

The Charities Regulator launched a Charities Governance Code in late 2018. This Code sets out a mandatory standard for governance in Irish charities. The Code identifies six principles on which good governance is based. By looking at these principles, we can identify some of the key responsibilities for charity trustees.

The six principles are:

Advancing Charitable Purpose;

Behaving with Integrity;

Leading People;

Exercising Control;

Working Effectively;

Being Accountable & Transparent.

Unincorporated associations

Smaller charitable organisations can be unincorporated associations governed by a constitution or set of rules. These organisations are like clubs and consist of people bound together by mutual agreement, who meet on a regular basis to pursue a common interest.

The constitution is binding for members of the organisation, but it has no legal effect on non-members. Therefore, anything done by the organisation is done by all the members of the organisation, who are responsible for all the activities of the organisation. Individual members are personally liable for any of the organisation’s debts or obligations.

An unincorporated association is not a separate legal entity from its members, and it does not have limited liability or a legal personality of its own. This means that it cannot enter into contracts or own property.

Charitable trusts

A charitable trust is established under a deed of trust. This means that the trustees must use all of the trust’s property to advance the charity’s purpose (except for money used to manage the trust).

Company Limited by Guarantee (“CLG”)

Charities are often established as companies. These are usually companies limited by guarantee and governed by a constitution (formerly known as a memorandum and articles of association). Companies are subject to company law and must comply with the rules about keeping accounts and records. Company law is enforced by the Companies Registration Office14 and the Office of the Director of Corporate Enforcement15.

A CLG must have at least two directors (every director aged at least 18 years, one EEA-resident) and a person may not have more than twenty-five (25) directorships in CLGs or other types of Irish company (subject to certain group-related exceptions).

One of these directors will be permitted to be the company secretary.

Unless its constitution provides otherwise, the remuneration (if any) of directors of a CLG must be determined in general meeting by its members. The Charities Act 2009 (and Revenue rules currently) restricts the ability of charities to pay directors. Proceedings of Directors Unless the constitution of a CLG provides otherwise a director of a CLG:

may not vote in respect of any contract, appointment or arrangement in which he or she is interested and shall not be counted in the quorum;

may not hold any such position in conjunction with his or her office of director and;

must retire by rotation.

Trusts

The trusts are established under a deed of trust. This means that the trustees must use all of the trust’s property to advance the charity’s purpose (except for money used to manage the trust). Once the trustees act within their authority for furthering the purposes of the charity, then their decisions are binding upon the members.

The role of the Chairperson of a charity

Charity trustees are the people who ultimately exercise control over, and are legally responsible for, the charity. Each board of charity trustees should have a chairperson whose duties include:

Leading the board;

Ensuring smooth running of board meetings;

Promoting good governance among fellow charity trustees;

Providing supervision and support to the manager/CEO (where applicable);

Acting as a figurehead or spokesperson where required.

The Charities Regulatory Authority (CRA) is an independent regulatory agency of the Department of Justice and Equality. The Charities Regulatory Authority’s functions include the establishment and maintenance of a register of charitable organisations. It is also charged with promoting compliance by charity trustees with their duties in the control and management of charitable trusts and organisations.

As per Article 14 of the Charitable Act 2009, the functions of the Charities Regulatory Authority are as follows:

increase public trust and confidence in the management and administration of charitable trusts and charitable organisations,

promote compliance of charity trustees with their duties in the control and management of charitable trusts and charitable organisations,

promote the effective use of the property of charitable trusts or charitable organisations,

ensure the accountability of charitable organisations to donors and beneficiaries of charitable gifts, and the public,

promote understanding of the requirement that charitable purposes must confer a public benefit,

establish and maintain a register of charitable organisations,

ensure and monitor compliance by charitable organisations with this Act,

carry out investigations in accordance with this Act;

encourage and facilitate the better administration and management of charitable organisations by the provision of information or advice, including in particular by way of issuing (or, as it considers appropriate, approving) guidelines, codes of conduct, and model constitutional documents,

carry on such activities or publish such information (including statistical information) concerning charitable organisations and trusts as it considers appropriate;

provide information (including statistical information) or advice, or make proposals, to the Minister on matters relating to the functions of the Authority.

The CRA also takes on the functions of the Commissioners of Charitable Donations and Bequests for Ireland.

According to Article 52 of the Charities Act (Article 52) the charity trustees of a charitable organisation shall, not later than 10 months or such longer period as the Authority may specify, after the end of each financial year, prepare and submit to the Authority a report (in this section referred to as the “annual report”) in respect of its activities in that financial year.

The following shall be attached to an annual report submitted by a charitable organisation:

a copy of the annual statement of accounts or the income and expenditure account and the statement of assets and liabilities, as the case may be, in respect of the financial year concerned;

where the accounts of the charitable organisation have been audited, a copy of the auditor’s report;

where the accounts of the charitable organisation have been examined by an independent person, a copy of the independent person’s report.

A copy of the accounts prepared by a charitable organisation in accordance with the Companies Acts shall, in respect of the financial year concerned, be attached to an annual report submitted by that charitable organisation. This applies to a charitable organisation that is a company, and is not required to annex its accounts to the annual return made by it to the registrar of companies under the Companies Acts.

An annual report submitted to the Authority and any document attached thereto shall be kept by the Authority for such period as it thinks fit.16

Unincorporated association

An unincorporated association is not a separate legal entity nor does it have limited liability or a legal personality of its own. This means that it cannot enter into contracts or own properties.

Trust

In a trust, one or more persons operating under the authority of a “deed of trust” hold funds or property on behalf of other persons.

Company Limited by Guarantee (“CLG”)

A charitable company, as an incorporated body, can own property, will be liable for its own debts, and can transact business with third parties.

General requirements for winding up a charity

Because the winding up of any charity may raise important questions for the Charities Regulator, the charity must always, before starting a winding up, notify the Charities Regulator of its intention to wind up. This is required by section 39 of the Charities Act 2009).

Further to section 92 of the Charities Act, any surplus in the charity’s assets or funds may not be paid to the members of the charity without the Charities Regulator’s prior consent, even if such payment is permitted by the charity’s own constitutional documents or internal rules.

Under section 47(8) of the Charities Act, the trustees of the charity (or where relevant, the liquidator) must retain the financial statements of the original charity for at least six years after the winding up is completed.

Unincorporated Association

While it is relatively easy and inexpensive to set up an unincorporated charity, it is very important to ensure that all outstanding matters and issues are fully dealt with if it is wound up, because members or trustees could be made personally liable for any unsatisfied debts or obligations.

The board of trustees should ensure that the general requirements, including notifying the Charities Regulator in advance of taking any action are satisfied. They should also carefully follow any procedure set out in the governing document for winding up, as the governing document operates as a contract among all members. Where the charity’s governing document includes specific provisions for a winding up, these should be followed as they are legally binding.

The board or trustees should be conscious that after an unincorporated charity is dissolved, they will still hold any of the charity’s remaining assets on trust to be used for charitable purposes. They should remain aware of the danger of acting in breach of trust, for example, by donating the charity’s assets to a charity with charitable purposes which are inconsistent with those of the dissolving charity.

The High Court has, in certain circumstances, the power to wind up an unincorporated association. It is important to note that if the winding up of an unincorporated charity is not conducted properly, there is a risk that an interested person could apply to the court to order that a liquidator be appointed to wind the charity up.

Trust

The trustees of a charitable trust should ensure that the general requirements, including notifying the Charities Regulator in advance of taking any action are satisfied. The trustees must also pay particular regard to the governing document of the charity, usually a deed of trust or declaration of trust. The trustees should carefully follow any procedure set out in the governing document for winding up, as the governing document is the source of both legal powers and legal duties of the trustees and are legally binding on the trustees.

Where there is no specified winding up procedure in the governing document, the following steps are recommended (however, any charity contemplating such a course of action should take advice appropriate to its own circumstances before proceeding):

the charity should issue notice to the trustees of an extraordinary general meeting (EGM) proposing to wind up the charity (usually 28 days’ notice is standard);

the Charities Regulator also requires that a copy of the notice of the trustees’ meeting be sent to the Charities Regulator at the same time as it is sent to the trustees;

the motion to wind up the charity should authorise the trustees (or identified trustees) to deal with matters including donation of any surplus assets or funds to a charity with a similar charitable purpose to that specified in the charity’s governing rules; payment of all the charity’s remaining debts; closing the charity’s bank accounts; liaising with Revenue and the Charities Regulator to de-register the charity and ensuring all other necessary steps to fully and finally wind up the charity’s operations are taken;

the trustees should vote to pass the motion to dissolve the charity, either by a special (75%+) or ordinary (50%+) majority.

The charity trustees should be conscious that after a charitable trust is dissolved, they will still hold any of the charity’s remaining assets on trust to be used for charitable purposes. They should remain aware of the danger of acting in breach of trust, for example, by donating the charity’s assets to a charity with a charitable purpose which is inconsistent with the dissolving charity’s purpose.

Company Limited by Guarantee (“CLG”)

A CLG is a separate legal entity, which exists independently of its members. As such, a charity which operates in the form of a company must be wound up in accordance with the Companies Act 2014.

When considering winding up, a charity that is a limited company charity should also always have regard to any provisions in its Constitution relating to winding up. When considering any major change, it is wise for any charity to ensure that the Charities Regulator is kept aware of its plans and how they are progressing. It is also important to ensure that the charity has access to appropriate professional advice on how to proceed. If the charity cannot afford its own legal advisor, free or low cost legal advice may be sourced through various NGOs and schemes. The principal ways to wind up a limited company are by voluntary strike-off, involuntary strike-off or by liquidation.

Liquidation involves appointing a liquidator who is responsible for managing the winding up of a company. A liquidator is usually a professional accountant familiar with the winding up process. A benefit of liquidation is therefore that the members can rely on the professional liquidator and have a less active role in the winding up; however, the liquidator’s fees must be met and this will reduce any remaining charitable assets, so it is important to be clear about what fees are likely to arise

Charity trustees are responsible for the management of a charity. They must ensure that they are overseeing the charity’s operations and making any necessary decisions. Charity trustees must meet on a regular basis to enable them deal with issues as they arise.

For a company limited by guarantee (CLG), particular provisions apply to the holding of its members’ meetings, such as the annual general meeting.

General duties of charity trustees come from common law.

The duties as a charity trustee come from the following:

The governing document of the charity;

Legislation (statute);

Common Law (the body of Irish law based on established practice and decisions of

the courts).

Charity trustees have specific duties under the Charities Act 2009 and are also required to ensure that their charity complies with the requirements of other relevant legislation e.g. data protection legislation, employment legislation, health and safety legislation etc. Where a charity is a company, a charity trustee who is also a director of the company has additional duties under company law and common law in their capacity as company directors.

The charity trustees may often be required to make decisions regarding investment of the charity’s money. In doing so, they must exercise due skill and care and act in the best interests of the charity when investing its assets. If, as a charity trustee operating pursuant to a trust deed, they need to invest or agree to the investment of money outside of the scope of their authority, they may be held personally liable for any loss.

17. Taxation regimes

Being registered with the Charities Regulator is separate from being granted a charitable tax exemption. A charity must be registered with the Charities Regulator before they can apply for a charitable tax exemption. The Revenue Commissioners decide if an organisation is a charity for tax purposes and whether it qualifies for a tax exemption.

The tax regime in Ireland with relevance to the activities of the charities includes several types of tax reductions affecting: income tax, corporation tax (in the case of companies), capital gains tax, Deposit Interest Retention Tax (DIRT), capital acquisitions tax, stamp duty, and dividend withholding tax.

The charitable entities are not exempt from VAT. Despite this, many items that relate to charitable activities are exempt. To qualify as charitable organization, the purpose of the organization must appear on the list of purposes in Section 3 of the Charities Act and must also be of public benefit (Charities Act 2009 Section 3(2)).

Organizations eligible for charitable status do not enjoy a general exemption from Value Added Tax (VAT). Charities, which are trading (such as for example selling publications or operating a restaurant) are obliged to register for VAT if they exceed the threshold for registration (EUR 37,500 for the supply of services or EUR 75,000 for the sale of goods).

In addition, tax relief is available for donations to ”approved bodies”, including “eligible charities”. An eligible charity is a charity which is approved in writing by Revenue17. If an Irish taxpayer donates €250 or more to a registered charity in any year, the charity can claim 45% in tax relief under the Charitable Donation Scheme.

The following donations apply to approved bodies qualify for tax relief:

a minimum donation of EUR 250;

a maximum donation of EUR 1,000,000 in any one year.

Relief will be restricted to 10% of the donor's annual income if there is a connection between the donor and the approved body (which includes the eligible charities). An approved body may claim 31% tax relief on the donation. They receive the grossed up amount, net of tax deducted at the specified rate.18

Number of charities in Ireland in 202019

There were 74,124 charity trustees on the Register of Charities on 31 December 2020, an increase of 10% comparing to 201920.

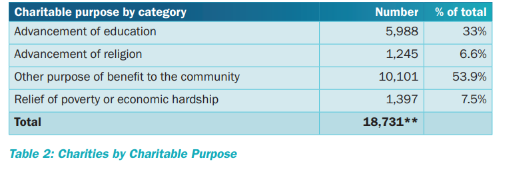

Type of activities by 202021

The total turnover of the charity sector in 2021 was: EUR 13.9bn.

In 2021, the economic weight of the charity sector in Ireland is 3% of the GDP.

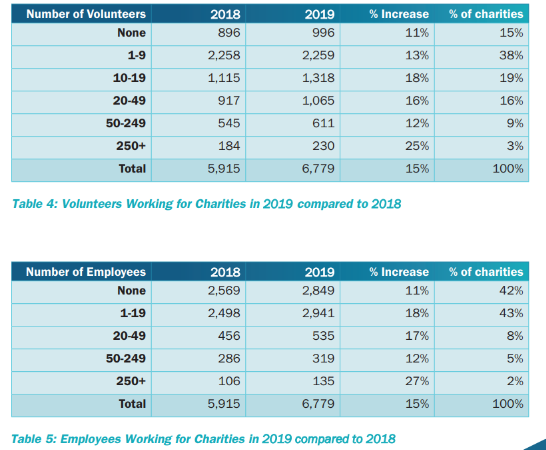

The share between volunteering and paid work is as follows22.

In Section 39 of the Charities Act 2009 there is a provision which facilitates the registration of charities established in other European Economic Area (EEA) jurisdictions.

In the Charities Act 2009, Section 1, under the section on preliminary and general provisions, defines that EEA state means a member state of the European Union(other than the State), or a state (other than a member state of the European Communities) that is a contracting party to the EEA Agreement.

Thus, in this law, it gives special emphasis and place to the EEA countries. Then, throughout the text of the law in several places, depending on what is regulated, the importance of these countries is emphasized in a way of a privileged and almost equal status with the domestic legislation.

https://www.charitiesregulator.ie/en/information-for-charities/who-is-a-charity-trustee

https://www.charitiesregulator.ie/media/2036/information-note-charities-governance-code-reporting-in-2021.pdf

https://www.legislationline.org/legislation/section/legislation/country/23/topic/1

https://www.legislationline.org/documents/action/popup/id/5023

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021SC0715

https://www.irelandcompanyformation.com/open-a-non-profit-organization-in-ireland

https://www.irelandcompanyformation.com/open-a-non-profit-organization-in-ireland

https://www.gov.ie/en/service/d92a33-how-to-find-legislation/

https://cunninghamsolicitors.ie/step-by-step-how-to-register-as-an-irish-charity/

https://www.cro.ie/en-ie/Registration/Company/Required-Steps

https://www.cro.ie/en-ie/Registration/Company/Required-Steps

https://cunninghamsolicitors.ie/step-by-step-how-to-register-as-an-irish-charity/

https://www.charitiesregulator.ie/en/information-for-charities/myaccount

https://www.charitiesregulator.ie/en/information-for-charities/apply-for-charitable-status

https://www.charitiesregulator.ie/en/information-for-charities/apply-for-charitable-status

https://www.charitiesregulator.ie/en/information-for-charities/frequently-asked-questions

https://www.charitiesregulator.ie/media/1078/guidance-for-charity-trustees-july-2017.pdf

https://www.charitiesregulator.ie/en/information-for-the-public/useful-website-links

https://www.counterculturellp.com/blog/charity-governance-members-trustees/

https://www.citizensinformationboard.ie/downloads/relate/Relate_2018_05.pdf

https://www.wheel.ie/sites/default/files/media/file-uploads/2018-08/Factsheet_Forming_A_Charity.pdf

https://www.charitiesregulator.ie/media/1692/the-role-of-the-chairperson-of-a-charity.pdf

https://www.charitiesregulator.ie/media/2329/annual-reporting-information-note-final.pdf

https://www.charitiesregulator.ie/en/information-for-charities/who-is-a-charity-trustee

https://www.charitiesregulator.ie/media/1078/guidance-for-charity-trustees-july-2017.pdf

https://www.companyformations.ie/company-formations/dac-designated-activity-company-ireland/

https://www.citizensinformationboard.ie/downloads/relate/Relate_2018_05.pdf

https://www.companyformations.ie/company-formations/irish-company-limited-by-guarantee-clg/

https://www.companyformations.ie/company-secretarial/application-for-charitable-status/

https://revenue.ie/en/companies-and-charities/charities-and-sports-bodies/index.aspx

https://www.matheson.com/insights/detail/liability-in-unincorporated-associations

https://www.revenue.ie/en/corporate/information-about-revenue/role-of-revenue/core-business.aspx

https://www.businesssetup.com/ie/company-limited-by-guarantee-clg-ireland

https://www.charitiesregulator.ie/media/1670/guidance-on-winding-up-a-charity.pdf

https://www.wheel.ie/advice-guidance/governing-your-organisation/role-trustee

https://www.charitiesregulator.ie/media/2211/final_charities-regulator-annual-report-2020.pdf, p. Page 15.↩︎

https://www.citizensinformation.ie/en/government_in_ireland/irish_constitution_1/constitution_fundamental_rights.html↩︎

https://www.cof.org/country-notes/nonprofit-law-ireland#Types↩︎

Excluded bodies include: a political party, or a body that promotes a political party or candidate (there are separate registration requirements for political parties); a body that promotes a political cause, unless the promotion of that cause relates directly to the advancement of the charitable purposes of the body (see below); sporting bodies (see below); a trade union or a representative body of employers; a chamber of commerce; a body that promotes purposes that are unlawful, contrary to public morality, contrary to public policy, in support of terrorism or terrorist activities, or for the benefit of an organisation, membership of which is unlawful.↩︎

https://www.charitiesregulator.ie/media/1479/model-constitution-clg.docx↩︎

https://www.charitiesregulator.ie/en/information-for-the-public/search-the-register-of-charities↩︎

https://hayes-solicitors.ie/News/Supreme-Court-judgment-has-important-consequences-for-employers-and-members-of-unincorporated-associations#:~:text=Members%20of%20unincorporated%20associations%20can,act%20itself%20was%20carried%20out.↩︎

https://www.matheson.com/insights/detail/liability-in-unincorporated-associations?utm_source=Mondaq&utm_medium=syndication&utm_campaign=LinkedIn-integration↩︎

https://www.charitiesregulator.ie/media/1078/guidance-for-charity-trustees-july-2017.pdf↩︎

https://www.businesssetup.com/ie/company-limited-by-guarantee-clg-ireland#:~:text=A%20Company%20Limited%20by%20Guarantee,the%20event%20of%20winding%20up.↩︎

Charities Act 2009 Section 3(1)↩︎

The Office of the Revenue Commissioners was established by Government Order in 1923. The Order provided for a Board of Commissioners. The core business is the assessment and collection of taxes and duties. Revenue's mandate derives from obligations imposed by statute and by the Government and as a result of Ireland's membership of the European Union (EU).↩︎

https://www.cro.ie/en-ie/↩︎

https://www.odce.ie/↩︎

https://www.irishstatutebook.ie/eli/2009/act/6/enacted/en/print↩︎

This body is explained in footnote no. 18↩︎

Example: In case of a donation of €250, the approved body is deemed to have received a gross donation. The gross donation is calculated as follows: €250/(100%-31%)=€362.32. The approved body can claim a refund of €112.32 which is €362.32x31%.↩︎

https://www.charitiesregulator.ie/media/2211/final_charities-regulator-annual-report-2020.pdf↩︎

https://www.charitiesregulator.ie/media/2211/final_charities-regulator-annual-report-2020.pdf, p. Page 15.↩︎

ttps://www.charitiesregulator.ie/media/1947/charities-regulator-annual-report-2019.pdf↩︎

https://www.charitiesregulator.ie/media/1947/charities-regulator-annual-report-2019.pdf↩︎